A very common query I come across of NRI’s settled outside is regarding the India tax implication of the transfer of money – to the NRI as well as the person to whom transfer is made. Today, I will be clarifying on this aspect using different scenarios.

First things first: Clarify on the nature of the transaction

The tax and FEMA implications of the transaction will differ depending on the NATURE of transaction – whether it is a gift or a loan.

The point on how to determine the nature of transaction depends on what is the underlying intention of parties – is it that a person giving money as a gift does not want it back ever, or it is in nature of a loan and person intends it to be returned back after some time period.

This understanding has to be clear BEFORE making a transaction and not after, when you receive an Income Tax notice.

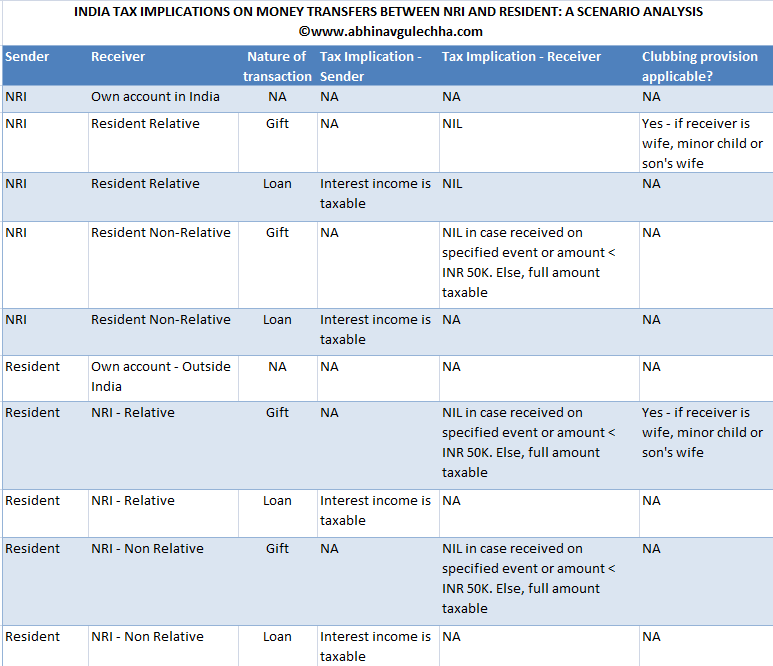

Various scenarios of money transfer between resident and NRI & resulting tax implications

I have captured various money transfer scenarios along with applicable tax consequences in the table below:

Important points in the context of above table

- As regards gift of money, the sender can be anyone (individual/HUF/partnership/company/trust etc.) however receiver can be only individual/HUF. However, Finance Bill 2017 has expanded the receiver list to mean ANY person receiving the gift and not just individual/HUF. The amendment, if passed, will take effect from FY 2017-18 – I’ve done a detailed analysis of this change here: Analysis of Finance Bill 2017 & Implications for NRI

- The tax implication we’re talking about in this post is on the money that has been sent and NOT the income from the investment of that income. If your query is on the “income” component, please put in comments section and I will reply to my best.

- Wherever I’ve used NRI in this post, it equally applies to a non-resident person of Indian origin (PIO).

- To avoid tax liability, NRI should not “receive” any foreign income directly in India. He should “receive” it outside India in a foreign bank account and then “remit” it from that account to a bank account in India. It is a well settled principle in Indian tax law in view of decision of Hon’ble Supreme Court in the case of Azadi Bachao Andolan that it is the receipt of income is taxable in India and NOT remittance. This point is especially relevant to seafarers who are bearing brunt of IT notices on their foreign incomes received in NRE account in India -on that issue, you can read more here: Analysis of Finance Bill 2017 & Implications for NRI

- Apart from taxation, FEMA rules also apply to these transfers – I have covered FEMA provisions in these posts please check: FEMA Implications on NRI Gift Transactions: A Scenario-wise Analysis and FEMA Implications on NRI Loan Transactions: A Scenario-wise Analysis

- Notwithstanding the tax implications mentioned in this post, Section 68 of the Income Tax Act (ITA) allows Income Tax Department (ITD) to treat any credit entry in a person’s bank statement if assessee cannot offer clear explanation of source – a genuine gift from an NRI to his father can also qualify for Section 68– I’ve written a detailed post on this issue and precautions to take, please check: Gift by NRI to Resident: Also be aware of Section 68 of ITA

- In India, tax implication, is on the RECEIVER of money, not the sender. However, sender (if NRI) should know the applicable tax rules of the country where he is a tax resident for any tax implication or reporting requirement – for example, USA prescribes a tax free gift limit as well as requires a person to report it to IRS on giving as well as receiving a gift above a certain limit – I’ve captured it in a detailed post here: Understanding US and India Tax Implications on “gift” transactions

- Even if the gift is exempt in hands of receiver in India, it is advisable that receiver discloses it under “Exempt Income” category in the tax return that he files in India.

- Gift to minor child, spouse or son’s wife will attract clubbing provision – i.e. income from any investment of that money will be clubbed in hands of sender. However, note that clubbing applies to only first level and not to subsequent levels – income from income of gifted money is not clubbable.

- For the purpose of this post, I’ve restricted myself only to a situation where the transfer of “money” is involved and that too between individuals. In case transfer involves property/shares etc. and/or between persons other than individuals, it becomes complex and I will cover such situations in later posts.

- If NRI gives a loan to a person in India, the interest income on that loan will be eligible to qualify within the qualifying exemption limit of INR 2.5 lacs. Hence, if total income including interest income is below INR 2.5 lacs, there is no need to file tax return and pay tax by the NRI. However, in my view, NRI should file tax returns in India even if nil income, read more here: Why Returning NRIs should continue filing tax returns even if no taxable income

- U/s 56 of ITA, gift received by individual/HUF on specified event like marriage, under a will or inheritance, in contemplation of death or from a relative are completely exempt irrespective of amount.

- In case of resident making a remittance outside India, he can do so only within the limits of Liberalised Remittance Scheme of RBI – read here for complete details of this scheme: Liberalised Remittance Scheme (LRS) under FEMA: Analysis & Issues

- In case resident gives a loan to NRI and receives interest income, the same qualifies as a “foreign source income” and must be disclosed in Schedule FSI at the time of filing the Indian tax return. In such a case, resident will have to file a tax return in India irrespective of the level of income. Read more here: Black Money Act: An Analysis

- In case of gift from resident to a non-relative NRI in excess of INR 50K, question is: will it be taxed to such NRI in India? Opinions are divided on this, however in my view gift is taxable for the NRI in India. I am saying this because Section 9 says that if source of income is located in India, income is taxable in India irrespective of residential status of a person. Further, Section 2(24) which defines “income” includes gift. In such a case, source of income is the person giving the gift. In case any tax is deducted by the foreign country, same can be claimed as tax credit in Indian tax return.

Some tips on structuring a tax efficient cross border gift transaction

- Ensure that gift is made to a relative as defined in Section 56 of ITA.

- If gifting to a non-relative, try to gift the amount around his marriage or make it a part of your will or split the total amount into < INR 50K and give every year

- As far as possible, avoid gift if recipient is a minor child, spouse or son’s wife. If still it is made, try and ensure that the recipient invests the money in tax free avenues in India for example, equity shares (not sold within 1 year), tax free bonds (held till maturity), PPF etc.

- Avoid gifting with intent to invest in parent’s name and escape tax liability – it is risky and ITD can treat it as a sham transaction to avoid tax – from a conservative standpoint, I would not even want to structure it as a loan – avoid investing in India in that way – as far as possible, invest in your own name in India and avoid routing your investments through a relative/third person.

- Execute a gift deed – check this format. If amount is not very high, it can be done on a plain paper – else, I will recommend notarization to avoid issues.

- Avoid accepting gift from a person who is not very much known to you. It is for the reason that if the Assessing Officer treats gift as a cash credit u/s 68, onus will be on you to explain that gift is genuine and you may need good degree of co-operation from such donor to make your case in front of the AO.

Some tips on structuring a tax efficient cross border loan transaction

- In case of loan transaction, ensure that you adhere to the FEMA norms as well.

- Execute a proper loan agreement documenting intention of both parties.

- NRI giving loan to a resident can give an interest free loan. That way, there will be no interest income for the NRI lender to be offered to tax in India.

- Avoid accepting loan from a person who is not very much known to you. It is for the reason that if the Assessing Officer treats loan as a cash credit u/s 68, onus will be on you to explain that the transaction is genuine and you may need good degree of co-operation from such lender to make your case in front of the AO.

Hope the post has been of service to you. In case of any thoughts/feedback, please let me know in the “comments” section below.