Lot of returning NRIs prefer to create a private trust in a low tax jurisdiction and transfer their assets out of their overseas earnings into that trust, for beneficiaries who are generally children and family members. In my earlier post, I’ve discussed the taxation of private trust in India.

However, some specific tax issues exist in case of offshore trust structures which I am going to discuss today in this post.

Residential status of an offshore private trust

As regards residential status and tax incidence, since trust is not recognised as a separate person in the eyes of ITA, hence IMO the residential status of the beneficiaries (and not the settlor or trustees) is what will be relevant and the tax incidence will flow accordingly, as laid out in Section 5 and 9 of ITA. However, if the trust is a revocable trust, the residential status of settlor assumes significance in view of anti avoidance provision u/s 61 of ITA

It is important to state here that though Section 6 talks about residential status of other person (other than individual and company) to be in India unless control is wholly outside India, in my view that provision will not apply to trust structure.

Also read: Rules on Residential status of “Company” under Income Tax Act: An Overview

Even if settlor is giving directions on management of trust from India, the residential status of beneficiaries and location of assets of the trust need to be looked into – if all beneficiaries are non-resident and all assets are located outside India, income of trust CANNOT be taxed in India. However, this is a disputable point on which there can be divergent opinions.

- Settlement of assets in the trust

Taxation on settlement of assets in a trust is already a grey area and recent Finance Act, 2017 amendments have not made it any easier.

Per-se, if it is an irrevocable trust, legal position for taxability at the time of settlement of the trust should stay the same irrespective of location of asset settled in the trust and residential status of the beneficiary.

Yes, when income is generated or asset is distributed to beneficiary, tax position will change basis residential status of beneficiary and location of the trust, which I shall be coming to in the later paragraphs in the post.

So, if the settlement is done by individual solely for benefit of a relative, the transfer of assets to a trust is not taxable u/s 56 irrespective of location of asset or residential status of the beneficiary.

However, after the latest amendment in Section 56 by the Finance Act, 2017, in case beneficiary is not a relative or in case of multiple beneficiaries of the trust, one or more beneficiaries are non-relatives, then tax incidence u/s 56 shall get attracted and to the extent that beneficiary shares are specified (specific trust), the non-relative beneficiaries will be taxed w.r.t. their shares in the settlement. However, in case of discretionary trust, it is again a grey area as to how much settlement should be allocated to non-relative beneficiaries, or is it that the entire settlement be taxed in trust’s hands at MMR.

- Income of the trust

In my opinion, income of a trust incorporated in a foreign jurisdiction will be taxable in India in the following situations:

- Assets of trust are located in India AND/OR

- Beneficiary is an Indian resident#

# In case of discretionary trust, the trust’s income is taxable in India in the hands of the beneficiary on distribution basis only, in view of clear SC decision in case of [2014] 45 taxmann.com 552 (SC) Commissioner of Wealth Tax, Rajkot v. Estate of HMM Vikramsinhji of Gondal)

If any of the above conditions is not satisfied, the income of the offshore trust will NOT be taxable in India.

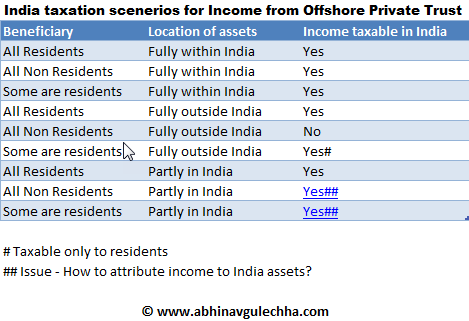

For ease of understanding, the various scenarios have been captured in below table:

An issue is – what if a part of the assets of the trust are located in India – in that case, will whole of the income of trust be taxable in India or only that part which is attributable to Indian assets will be taxable? If latter (being a more logical answer), what is the basis of attribution of profits? In such a case, maintaining accounts to bifurcate profits asset wise is also very impractical.

Also it may be noted that where conditions are satisfied, the trustee may be taxed in India u/s 166 – so, a BVI bank holding India assets in a trust may be assessed to tax by the AO in India, in view of the special powers it has u/s 166 to tax trustee or beneficiaries.

Also, in case there are any double tax implications on the same income, DTAA provisions and OECD guidance for the concerned Article of income will also need to be checked.

- Distribution from the offshore trust

Distribution from the offshore trust has two components: distribution of income vs distribution of assets. Let us discuss both separately for better understanding:

- Distribution of income:

If trust has been assessed to tax year on year u/s 166 by the AO, it is a settled law that distribution of such income in later years to the beneficiary will not be taxed in the hands of beneficiary.

However, if trust has not been separately assessed, beneficiary should first check whether the income is taxable in his hands u/s 5 of ITA which is only in 2 situations – beneficiary is a resident of India and/or the assets from which income has arisen are located in India.

If any of the above conditions are not satisfied, distribution of income is not taxable in India. However, if conditions are satisfied, beneficiary should add the income in their own tax return and pay the applicable tax.

- Distribution of assets:

The distribution from trust may also comprise “assets” which were originally settled in the trust. Now, while Section 56 as amended exempts settlement of assets to a trust in case beneficiary is a relative, there is no such exemption for a reverse scenario – where trust distributes assets to beneficiary.

This is a grey area of law. My personal view is that settlement of asset into the trust is the only relevant event for taxability as far as assets is concerned. Whether asset is taxable in beneficiary’s hands is to be ascertained at that point. Later on, at the time of distribution, Section 56 applicability should not be examined afresh on such distribution. However, how good this view holds in eyes of an AO is anybody’s guess.

Even if this stand is to be taken, it is vitally important that trust accounts are maintained in such a way that the distribution should contain a breakup between distribution of income vis a vis distribution of assets. Otherwise, the AO may simply treat entire distribution as income and try to tax it in hands of beneficiary.

Also please note the following points, which are very relevant to offshore discretionary trusts:

- Where the assessee claims that the distribution from a discretionary trust is not taxable, onus of proof is on the assessee to prove that trust is a genuine discretionary trust, especially in a case where it is located out of India – refer my analysis of recent decision by ITAT in Som Datt’s case – Som Datt [ITAT]: Assessee to prove that offshore trust distribution is not taxable

- In case of an offshore trust, assessee also has a duty to prove that the source of funds for investment (settlement) in the offshore trust are genuine and not tax evaded funds, else the AO can treat the whole of the investment as undisclosed investment u/s 69 and proceed to tax it accordingly – this has been upheld in a recent decision by ITAT Mumbai – Manoj Dhupelia [ITAT] – Assessee must prove genuineness of offshore discretionary trust

Black Money Act implications on offshore private trusts

In 2015, the Indian government enacted Black Money Act to curb foreign black money. One of the main reasons for this Act to be enacted was to bring back the black money statshed in offshore tax havens to India. It may also be noted that effective 01/07/2015, BMA will assume exclusive jurisdiction over foreign undisclosed income and assets.

Also read: Black Money Act: An Analysis

It is commonly known that offshore private trusts being largely opaque structures and set up in jurisdictions which have high degree of secrecy laws on settlor and beneficiaries are directly impacted by this law and it is very important to study the implications of BMA to income and assets from these trusts.

Section 2(2) of BMA defines the word “assessee” as a person being a resident other than not ordinarily resident – that means, BMA provisions apply ONLY to a person who is a ROR as per the Income Tax Act (Also read: How to find your residential status as per Income Tax Act) – so, the Act does not apply to NR or RNOR beneficiaries

Trust has also not been separately recognised as an entity in BMA – In fact, BMA does not define the term “person” – Section 2(15) says that if a term is not defined in BMA, its meaning as per ITA has to be taken – and ITA does not define trust separately.

In Section 2(11) definition of undisclosed asset includes financial interest in any entity either in his name or “in respect of which he is a beneficial owner” where he has no explanation about source of the investment in the asset or explanation is not satisfactory

Section 4 very importantly speaks about the scope of undisclosed income and asset. It says that foreign income/asset not disclosed in the income tax return will be considered as undisclosed and the penal provisions of this Act shall apply.

If you see the tax return, Schedule FSI and FA require disclosure of details w.r.t. foreign income and asset respectively. More specifically, point F of Schedule FA requires information w.r.t. details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor. Following details are required:

1. Sr No

2. Country Code

3. Name of trust

4. Address of the trust

5. Name of trustees

6. Address of trustees

7. Name of Settlor

8. Address of Settlor

9. Name of Beneficiaries

10. Address of Beneficiaries

11. Date since position held

12. Whether income derived is taxable in your hands?

13. If (12) is yes, Income derived from the trust

14. If (12) is yes, Income offered in the return (amount, which schedule, Item no. of Schedule)

Some issues here are as follows:

- If the trust is incorporated in a country where there is no separate law for trusts, is disclosure not required? In my view, NO. Disclosure will need to be made in clause B, D or E as deemed fit.

- Does a NR trustee or settlor file a tax return in India in view of this requirement? Answer is NO – the requirement of filing a tax return under Explanation 2 of Section 139(1) is mandated only for a ROR.

- Can the settlor or trustee be held responsible for non-compliance of BMA? If you go by definition of undisclosed asset in Section 2(12), which requires that the asset is held in assessee’s name or of which he is a beneficial owner – going by this, liability under BMA can be affixed only on a ROR beneficiary, not on trustee and settlor – however this is my personal opinion & there can be different views on this.

- In case of discretionary trust where share of beneficiary is not known, the issue is how an ROR beneficiary disclose income in tax return – in my opinion, since the income accrues only on distribution, In years where there is no distribution, income can be disclosed as zero. Supporting evidence may be retained by the beneficiary to prove that the trust is a discretionary trust and there was no income distribution to the said beneficiary during that year.

GAAR implications on offshore private trusts

Offshore discretionary trusts have been rampantly set up by HNIs in low or nil tax jurisdictions to escape tax in India. The presumption is that till the time the trust does not distribute income or assets, no tax liability can be fastened on the beneficiaries who are Indian residents. So, effectively, an HNI can defer his Indian tax liability for years on end by using such structures. This tax loophole has till now been exploited by a lot of offshore tax consultants and trust formation companies.

However, the party is now over.

General Anti Avoidance Rules (GAAR) (contained in Sections 95 -102 of the ITA) have been effective 01/04/2017. These rules have the broadest coverage and say that a transaction or arrangement where the ONLY purpose is tax benefit can be treated as an “impermissible anti avoidance arrangement” which can then be disregarded by the Assessing Officer.

Hence, it is very important going forward not to create offshore trust structures ONLY for tax planning purposes, and instead use it for genuine and demonstrable succession planning objectives.

Other points on offshore private trusts

- If the offshore trust is found to be a sham and used to disguise proceeds of crime, the provisions of Prevention of Money Laundering Act (PMLA) and Benami Transactions Prohibition Act may also apply. Also, if FEMA contraventions are noted, equivalent assets of the settlor in India may be attached.

- While forming offshore trusts, the FATCA/CRS implications also need to be checked and compliance should be ensured – read this article in ET (also read: CRS & FATCA: Overview and Implications for USA based NRI)

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com