When we speak of business income of a foreign enterprise in India, there is this concept of “business connection” under Section 9 of the Income Tax Act.

In simple words, concept of “business connection” means that any income through a business connection is taxable in India. This is a very inclusive and wide definition whereby even a few days of stay in India will make the income taxable in India.

Now, a company resident in UK & carrying on business activities in India can claim applicability of India UK DTAA over the provisions of Income Tax Act, since as a general rule, assessee can claim provisions of DTAA over ITA if the former is beneficial to it.

In the DTAA, there is a corresponding concept/provision of “permanent establishment”, mostly represented by Article 5 of the DTAA.

Article 7 of the DTAA, which pertains to business profits, generally say that the profits of an enterprise can be taxed only in the country of residence (COR) however it can also be taxed in Country of Source (COS) ONLY IF THE ENTERPRISE HAS A PERMANENT ESTABLISHMENT (PE) IN THAT COUNTRY”

Effectively, for the scenario I was referring to, this means that the UK enterprise cannot be liable to tax in India w.r.t. business income in India UNLESS it is established that the UK enterprise has a PE in India.

Meaning of PE

First of all, let us look at the definition of PE in OECD Model Convention:

Before we proceed, please understand that definition as per OECD model reproduced here is only for understanding purpose – India generally follows the UN Model where definition may be slightly different – also, the definition varies from DTAA to DTAA. So, it is vitally important to check the respective DTAA.

Article 5: PERMANENT ESTABLISHMENT

1. For the purposes of this Convention, the term “permanent establishment” means a fixed place of business through which the business of an enterprise is wholly or partly carried on.

2. The term “permanent establishment” includes especially:

a) a place of management;

b) a branch;

c) an office;

a factory;

e) a workshop, and

f) a mine, an oil or gas well, a quarry or any other place of extraction of natural resources.

3. A building site or construction or installation project constitutes a permanent establishment only if it lasts more than twelve months.

4. Notwithstanding the preceding provisions of this Article, the term “permanent establishment” shall be deemed not to include:

a) the use of facilities solely for the purpose of storage, display or delivery of goods or merchandise belonging to the enterprise;

b) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or delivery;

c) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise;

d) the maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise or of collecting information, for the enterprise;

e) the maintenance of a fixed place of business solely for the purpose of carrying on, for the enterprise, any other activity of a preparatory or auxiliary character;

f) the maintenance of a fixed place of business solely for any combination of activities mentioned in subparagraphs a) to e), provided that the overall activity of the fixed place of business resulting from this combination is of a preparatory or auxiliary character.

5. Notwithstanding the provisions of paragraphs 1 and 2, where a person — other than an agent of an independent status to whom paragraph 6 applies — is acting on behalf of an enterprise and has, and habitually exercises, in a Contracting State an authority to conclude contracts in the name of the enterprise, that enterprise shall be deemed to have a permanent establishment in that State in respect of any activities which that person undertakes for the enterprise, unless the activities of such person are limited to those mentioned in paragraph 4 which, if exercised through a fixed place of business, would not make this fixed place of business a permanent establishment under the provisions of that paragraph.

6. An enterprise shall not be deemed to have a permanent establishment in a Contracting State merely because it carries on business in that State through a broker, general commission agent or any other agent of an independent status, provided that such persons are acting in the ordinary course of their business.

7. The fact that a company which is a resident of a Contracting State controls or is controlled by a company which is a resident of the other Contracting State, or which carries on business in that other State (whether through a permanent establishment or otherwise), shall not of itself constitute either company a permanent establishment of the other.

Important points from above definition

Some of the important points from above definition are as follows:

- There are 4 main types of PE formations possible – like a fixed place PE, service PE, agency PE and construction PE

- In case of fixed place PE, apart from PE existing in India, it should also carry out business activities in India

- PE definition is much narrower than “business connection” definition under ITA – however, care should be taken to see that a “force of attraction” clause is not present in the DTAA – because if it is, then it is advisable to consider the ITA provisions as compared to DTAA provisions.

- Even a Liasion Office (LO) of a foreign company can be treated as a PE in India, if it actually does business activities – Convergys case

- Mere fact that the assessee has filed a income tax return in India cannot be used as an inference that the said assessee has a PE in India – Linklaters v. Deputy Director of Income-tax (IT), Mumbai [2017] 79 taxmann.com 100 (Mumbai – Trib.)

- For a PE to exist, it has to act as a virtual projection of the foreign enterprise in India – Commissioner of Income-tax v. Visakhapatnam Port Trust [1983] 15 Taxman 72 (AP)

- Where there was some place at disposal of assessee a non-resident company registered in Mauritius or its employees during entire period of stay in India for rendering extensive services to Indian company, it constituted PE in India – [2014] 45 taxmann.com 112 (Mumbai – Trib.) Renoir Consulting Ltd. v. Deputy Director of Income Tax (International Taxation) 2 (1)

- Market survey, industry analysis, economy evaluation, furnishing of product information, ensuring distributorship and their warranty obligation, ensuring technical presentations to potential users, development of market opportunities, providing services and support information, procurement of raw materials and accounting and finance services etc qualify as “preparatory or auxiliary character” and such services cannot qualify as PE in India – Motorala case [2005] 95 ITD 269

- Where activities of liaison office of foreign company included not only preparatory or auxiliary service but also marketing services, liaison office would be treated as Permanent Establishment of foreign company and its income would be taxable in India – [2014] 51 taxmann.com 327 (Allahabad) Brown And Sharpe Inc.v.Commissioner of Income-tax

- In case of fixed place PE, there is a clear cut need to have some fixed, stable place for a decent duration to call it as PE. Now, the duration is not defined (unlike in case of construction or service PE where it is generally expressly defined by way of no. of months & days stay respectively) – in this regard, SC has recently decided in case of Formula One World Championship Ltd. v. Commissioner of Income-tax, (International Taxation)-3, Delhi [2017] 80 taxmann.com 347 (SC) where it was held that the F1 circuit was a PE for the FCo – extract of the judgment on this point is as follows:

“…………….

Not only the Buddh International Circuit is a fixed place where the commercial/economic activity of conducting F-1 Championship was carried out, one could clearly discern that it was a virtual projection of the foreign enterprise, namely, Formula-1 (i.e. FOWC) on the soil of this country. It is already noted above that as per Philip Baker (A Manual on the OECD Model Tax Convention on Income and on Capital), a PE must have three characteristics: stability, productivity and dependence. All characteristics are present in this case. Fixed place of business in the form of physical location, i.e. Buddh International Circuit, was at the disposal of FOWC through which it conducted business. Aesthetics of law and taxation jurisprudence leave no doubt in our mind that taxable event has taken place in India and non-resident FOWC is liable to pay tax in India on the income it has earned on this soil

…….”

PE vs Place of Effective Management (POEM)

I have written a detailed post on POEM applicability to foreign companies here: Rules on Residential status of “Company” under Income Tax Act: An Overview

In simple words, effective 01/04/2017, a foreign company is deemed to be a resident of India if its place of effective management (POEM) is in India.

POEM is a provision within Section 6 of Income Tax Act. If the company is deemed to be a resident of India as per POEM, its entire income is taxable in India by virtue of Section 5 of Income Tax Act. In this case, DTAA does not even come into the picture.

Having a PE in India means that only the income as attributable to the PE in India will be taxable in India and not the global income.

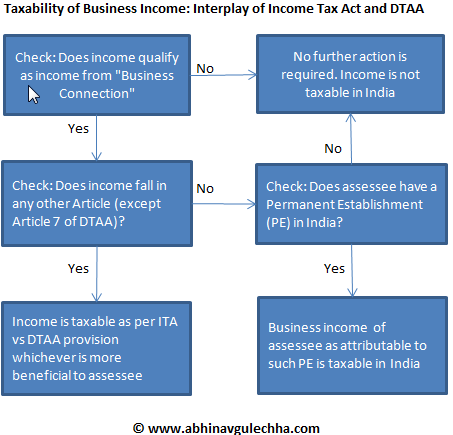

How to check whether income constitutes business income and chargeable to tax in India

One has to follow a step by step process to find out, as follows:

- First, check whether the income qualifies as arising from a “business connection” in India – in this regard, one has to be mindful that the definition is very wide and there is a high chance of it being covered in this definition

- If not, then the income is not taxable in India. Period. You do not need to check DTAA.

- However, if answer is yes, then you need to check DTAA.

- In DTAA, there are various Articles for various types of income. First, the substance of the income needs to be ascertained. In terms of interpretation of which Article applies, bear in mind that specific will overrides general. For example, if in substance, income is fee for technical services, Article corresponding to FTS will apply and not Article 7.

- In such a situation that an Article other than Article 7 applies, you need to compare provisions of ITA and DTAA and choose the one more beneficial.

- However, if no other Article (like FTS, Royalty, Shipping etc.) applies, AND substance of transaction is business income, Article 7 will apply. At this point, one needs to check if there is a PE in India AND income is earned from that PE in India.

- If answer is NO, then no income is taxable in India. Period. This is even where the income qualifies as “business income” – reason is that DTAA overrides ITA.

- If answer is YES, then the income of FCo will be taxable in India. Now, it is not that the entire income of FCo that will be taxed in India – it is ONLY the portion of profits that can be attributed to the said PE that will be taxable in India.

For ease of understanding, I have prepared a following flowchart to capture the above:

Implication of having a PE in India

- A proper computation of income attributable to such PE of FCo need to be done in accounts of FCo

- In case PE is an associate enterprise, transfer pricing study needs to be done as per ITA to establish that the transactions have been done as per ALP

- The said attributable income (if transactions cannot be proved to be executed at ALP) need to be offered to tax in India.

- FCo needs to file a tax return in India. For this, it has to obtain Permanent Account Number (PAN) in India.

- Any sum remitted by ICo to such FCo (if it constitutes income) is subject to provisions of Section 195 of Income Tax Act and appropriate TDS need to be deducted on such payments else the remitter (for example, Indian subsidiary) can be deemed as “assessee in default” u/s 201 of ITA

Grey areas in PE definition

- Is having a branch or an office by itself constitute a PE, or is it that only when business is carried on by such branch etc. that it will be construed as a PE – in this regard, OECD Commentary’s position is the former, however India has expressed its reservation to the commentary.

- As regards secondment of employees by foreign company (FCo) to Indian subsidiary (ICo), it still remains a grey area whether the re-imbursement of salaries of such deputees by ICo to FCo represents a capital receipt for FCo, or a fee for technical services (FTS) or such deputation makes the ICo as a PE of FCo and hence makes the income of FCo liable to tax in India – In this context, I’ve analysed certain decisions in this post: Foreign Co. deputing employees to India: Possible tax issues

- Easy to say that only the profits attributable to PE will be taxed – the difficult situation is that DTAA by itself does not prescribe any particular method – neither does it refer to the ITA – nor the ITA itself contains such a method – in terms of judicial precedents where court has held x % as attributable profits, there is a definite lack of consistency – hence, a scope for litigation here.

- However, in case where the PE is an associated enterprise (AE) of the FCo, there have been judgments where it was held that as long as transactions are at an arm’s length price (ALP), no profit can be attributable to India and liable to tax in India. Hence, in case of AE transactions, it is vital that a proper transfer pricing study is done and relevant documentation/audit report maintained, to prove ALP.

- As regards applicability of Section 206AA rate (in case FCo does not have a PAN in India), there are two ways – either find highest of the three rates (rate as per ITA, rate as per DTAA and 20%) OR another way (and which I would prefer) is to first compare rate as per ITA with rate as per DTAA – lower of the rate should be compared to DTAA to arrive at a final rate – however, there is a lack of clarity on this issue

- Though the assessee’s CAs lot of times rely on the OECD commentary on Model Tax Convention (even I have read the same thoroughly), however lot of times Indian courts have ignored the commentary – this is especially where India has itself expressed reservations on some key points in the commentary – so, the commentary cannot be blindly taken as a guide to interpreting the DTAA provisions

- The biggest lacunae of the PE definition in Model Convention is that it has not kept pace with the developments in e-commerce space – so, it is highly likely that for say an Amazon selling its product through a website to an Indian consumer, if we go by the existing definition of PE, there does not exist a PE in India – and that is why experts have recommended that in the changed scenario, there should additionally be added to the existing definition a new PE called “Significant Economic Presence” (SEP)

Before doing creative tax planning around PE, BEWARE of BEPS

Lot of companies over the years have structured their businesses in such a way that they technically escape from the clutches of the PE definition – and to curb this, OECD has carried out the Base Erosion and Profit Shifting (BEPS) project of which India is also a member.

In the final 2015 Report on BEPS, there is a special and dedicated Action Plan 7 on “Preventing the Artificial Avoidance of Permanent Establishment Status” which seeks to amend the PE definition in OECD convention which in turn would mean a re-write of DTAAs across the world to plug those gaps – it is highly recommended that the said Action Plan be studied thoroughly before structuring cross border tax transactions.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com