Last month, I was working on a case of an Ireland based Person of Indian Origin (PIO) who had returned back to India. He had worked in Ireland for good many years and accumulated a good amount of pension. This pension is termed as occupational pension in Ireland. It took him some time to settle down in India and while we were discussing on settling the overseas investments, transfer of the accumulated pension was on the top of our agenda, as the amount was big as well as client was intending to liquidate and invest in India, so that he can build a good rupee portfolio as otherwise his intention is to stay in India.

Last week, he provided me the transfer papers that he received from the group insurance provider in Ireland, and the options to move his pension out. In this article, I will list out what are the different avenues to do the same. However, please note that this is only a general article for information purposes & don’t take it as a financial advice. In case you are in a similar situation, it is advisable to consult a professional advisor before taking any decision.

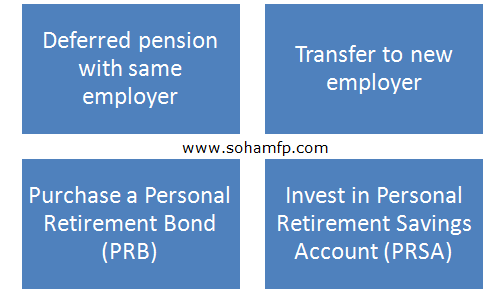

So, the available options as per the letter received from the pension manager were as follows:

Now, let us discuss all the options one by one so that we can understand the implications:

Option #1: Maintain the fund with the same employer

Though this seems to be the easiest, I will not prefer this, primarily due to the fact that I do not know whether this company will exist when I turn 60. And above all, I will want as much control over my money as possible. So, this option is out of question.

Option #2: Transfer the pension to the new employer

New employer here refers to a new employer based out of Ireland. Since the PIO client of mine has relocated to India, this option does not apply to him.

Option #3: Personal Retirement Savings Account (PRSA)

- Two types – standard and non-standard – standard has a max. 5% charge on each contribution & 1% FMC. Latter has no cap on charges.

- Difference between standard and non-standard PRSA is the fund choice and management charges. A standard PRSA can’t have a management fee over 1% and so some of our funds which have an extra management fee aren’t available through this product.

- Non-standard PRSAs have the same charges as standard PRSAs. The management fee may rise above 1% on non-standard PRSAs if funds with an extra management charge are chose by the client.

- Approved list of providers is maintained.

- You can normally start taking your benefits when you are aged between 60 and 75. You may be able to take your benefits earlier, for example, if you retire from employment at age 50 or over, or if you can no longer work because of a serious illness or disability provided you submit medical evidence

- Your PRSA fund is typically invested in company shares (equities), bonds issued by governments (sovereign bonds), bonds issued by companies (corporate bonds), property and cash. Your PRSA provider must give you information in relation to the types of assets in which your PRSA is invested. You control which funds your corpus is invested in, basis your risk profile.

- In case you die before 60, your legal heirs can receive it after paying inheritance tax as per Irish law.

- On retirement, you can take a lump sum at retirement of 25% of your PRSA fund’s value. This lump sum is currently (2012) tax free up to €200,000, and taxed at 20% between €200,001 and €575,000.

- With the remainder of your PRSA fund, you can:

- use the balance to buy an annuity, or

- eave the remaining funds in your PRSA and withdraw from them

- any time, subject to Revenue requirements (this is called a vested PRSA)

- transfer the balance to an approved retirement fund (ARF), subject to Revenue requirements

Option#4: Personal Retirement Bond (PRB)

Personal Retirement Bond, is basically a unit linked assurance policy, where you can transfer benefits of your occupational pension scheme at the time of leaving jobs. The broad features of PRB are as follows:

- You get to choose your investment options, and investment return is tax free.

- You can normally start taking your benefits when you are aged between 60 and 75. You may be able to take your benefits earlier, for example, if you retire from employment at age 50 or over, or if you can no longer work because of a serious illness or disability.

- When you retire you the options available to you will depend on the rules of the scheme you transfer from and may include:

- A Retirement Lump Sum (generally restricted upto 20% of corpus)

- An Annuity (subject to income tax and universal social charge)

- An Approved Retirement Fund (ARF)

- Taking an additional taxable lump sum

- There are 3 management fee options on our PRBs. A 1%, 0.75% and 0.5% AMC structure. Allocation of the clients funds depends on age, management fee chosen and amount invested.

- 5 year exit penalties will apply on this policy.

Other points:

- Most of the retirement fund managers in Irealand (for e.g. New Ireland Assurance), provide both PRSA and PRB options & approved for the same by Irish pensions authority.

- As an investor, you have to bear in mind that the corpus will be subject to exchange rate risks at the time of withdrawals on retirement.

- In case of early death, funds can be claimed by nominee however inheritance tax will apply.

- Past returns of around 10% given by the fund (referred to the Balanced Managed, Evergreen and Property Fund link on the New Ireland website) – past returns may not happen in future.

- You can access your policy details online – see this video

Tax provisions on accumulated pension under Irish tax law

- The investment returns are tax free under Irish law.

- Lump sum receipt at the retirement age is tax free up to €200,000, taxed at 20% between €200,001 and €575,000 and above that, it is taxed at the maximum marginal rate of tax.

- Inheritance proceeds are liable to inheritance tax under Irish law, unlike the law in India.

Applicability of India – Ireland DTAA on the accumulated pensions under Irish tax law

There may be a situation where the person is a resident of both countries in a particular year, or the income is taxable in both countries by virtue of the respective tax laws. In such case, I checked first whether there exists a double tax avoidance treaty between India & Ireland and answer was YES (check out Indian Income tax website for India’s DTAA with all countries).

On a finer reading of the provisions pertaining to the taxability of pensions of both countries, I came across the following and am reproducing the extract here:

PENSIONS AND ANNUITIES

1. Subject to the provisions of paragraph 2 of Article 19, pensions and other similar remuneration paid to a resident of a Contracting State in consideration of past employment and any annuity paid to such a resident in consideration of past employment shall be taxable only in that State.

2. The term “annuity” means a stated sum payable periodically at stated times during life or during a specified or ascertainable period of time under an obligation to make the payments in return for adequate and full consideration in money or money’s worth.

Hence, in view of the treaty, the proceeds of pension shall be taxed only under the Irish law and will not be taxed under the Indian law.

FEMA pointers on repatriation of lump sum and annuity receipt

Following are some pointers I could think of, on FEMA implications for inward repatriation of lump sum and annuities:

- If you are a foreign national at the time of retirement, the receipts can be credited in your resident account. If you choose to move out of India, you can re-designate it as NRO and remit out of India subject to USD 1 MN (present limit)

- If you are an NRI at the time of retirement, since the pensions represent foreign earnings, it’ll be allowed to be credited to your NRE account. The same can be fully repatriated.

- As regards the pension bonds or PRSA maintained in Ireland, FEMA allows even a resident Indian to maintain assets abroad as long as they were purchased in foreign currency.

- It is advisable to maintain one account in Ireland to receive credit of annuity proceeds in that account. The same is permitted by FEMA rules.

Implications of the Indian Black Money Act

As per the Black Money Law, if you are a “resident”, then you need to fill income tax return and disclose all foreign assets (which will include these pensions). Non disclosure may entail hefty penalties and even imprisonment.

References/Sources:

http://www.moneyadvice.ie/ProductLibraryDocuments/Buy%20out%20Bond%20v%20PRSA%20(Jan%202010).pdf

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com