Some days back, I was working on a profile a USA based NRI who was finding it tough to invest in Indian mutual funds but also did not want to lose out on India’s long term growth story. I tried to find out if there are dedicated funds in USA that invest in India. In this article, I will take you through my learning and request your feedback and opinions.

Why a strong case exists for investing in India focussed MF by USA based NRIs

Below are some of the reasons why it makes a lot of sense for a USA based NRI to invest in India focussed mutual funds:

- The IRS has made Passive Foreign Investment Company (PFIC) which taxes income from Indian mutual funds in a very different way and robs the tax advantage of investing in India. Also, it require US persons to comply with very stringent and messy reporting requirements. I have done a detailed post on PFIC rules and you can read it here

- There is a definite yield gap between the mature US markets vs emerging Indian markets and NRIs based out of USA may want to take advantage of higher returns from Indian equity markets.

- Investing in Indian markets make a lot of sense for those NRIs who wish to plan to return to India, in some years time. Though best option is to invest directly in Indian mutual funds to qualify them as INR assets, this is not possible now in view of FATCA and SEC requirements whereby most of the Indian mutual funds do not accept money from US persons.

- Even for a US person having no plans to return back to India, given the superior yields from Indian markets and an aim to diversify your portfolio into non-US assets, a person can look at investing in these funds.

Market for India focussed funds in the USA

I checked the Morningstar.com database for Indian funds – they have created a category “India Equity” and to date, there are some 18 India focussed mutual funds in USA.

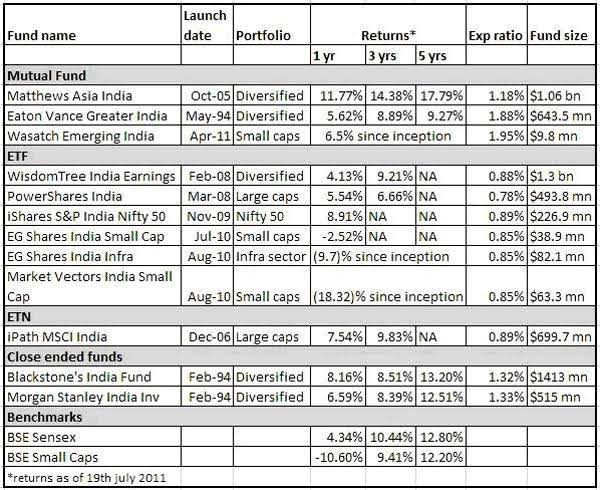

Below are some of the screenshots of these funds: (Go to Basic Fund Screener, choose category as “International Equity” and then a sub category “India Equity”)

Choosing the best India focussed mutual fund in USA

While selecting a mutual fund, I generally prefer to only focus on some key metrics like portfolio turnover ratio (lower the better), whether fund is diversified or concentrated (latter is better), expense ratio (lower the better) and the investment philosophy (I prefer funds which prefer bottom up stock picking and buy-and-hold philosophy).

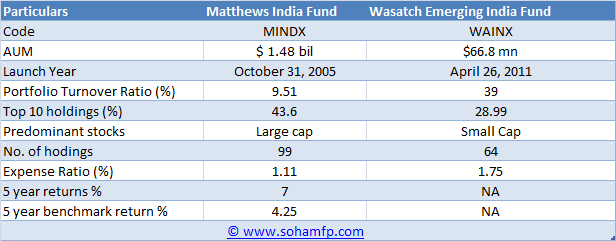

From the above screenshots, my choices are only two funds – Matthew India Fund and Wasatch Emerging India Fund. A snapshot of key data points in both funds is given below, which is followed by detailed reasoning:

Mathews India Fund (Code: MINDX)

Mathews is the largest dedicated Asia specialised mutual fund house in the USA. It has dedicated funds for each country like India, China, Korea etc. Speaking of the fund, it is a comparatively old fund with a good past track record. Past 5 and 10 year returns are 7% and 10.74% respectively. This fund has comfortably beaten the category as well as its benchmark in both 5 year and 10 year durations. In fact, it is the No. 1 fund in the 10 year category. The fund does not prefer holding cash, and is almost (95%) fully invested in Indian equities. The fund manager tenure has also been relatively stable. The fund has a very reasonable expense ratio of 1.11% which may be because of economies of scale. Investment objective of the fund does not indicate a bias to a certain size (large, small cap etc.) or style orientation (growth/value). If we see the portfolio composition, it is very much diversified with top 10 holdings comprising only 43.6%. Predominantly, you will find large caps like ITC, Infosys, Kotak etc however it does have an exposure to mid caps as well, like Emami, Mindtree, Eclerx etc. I also was pleased to note that they’ve put up an investment philosophy statement on their website that prescribes bottom up investing style. For more details on this fund, you can visit its website here

Wasatch Emerging India Fund (Code: WAINX)

Wasatch is a relatively recent entrant in this segment, with a launch in 2011. It follows the MSCI India IMI as a benchmark and since inception, it has secured a return of 7.96% as compared to a benchmark return of negative 1.92% which is quite impressive. I read the investment objective of this fund and it is basically a “small cap” fund. Even if you see the holdings, you’ll see mostly all small cap ones like Bajaj Finance, Makemytrip etc. with a small exposure to mid caps as well. Hence, this fund is comparatively more volatile as compared to Matthews India Fund. Expenses are at 1.75% (slightly higher than Matthews) but within acceptable range for an all equity fund. For more details on this fund, you can visit its website here

Before you take the leap, read these pointers

There is always a flip side to everything and investing in India focussed MF is no exception. Take a note of following points before you move forward:

- When it comes to choice, there aren’t many options in USA. I can think of only two funds mentioned above as sound cases to invest.

- When you invest in USA, you are creating a “$” asset. So, for NRIs planning to return back to India after some years, the hidden risk in the portfolio is “currency risk”. So, even if your portfolio makes a good gain, and in that period the USD/INR exchange rate moves up to say 60 (from existing 67), in that case, a chunk of your investment gains will be wiped out.

- Equity as an asset class (be it Indian or US equity) is a “risky asset”. You should first assess your risk tolerance from a competent professional (I use Finametrica for my clients) and take an exposure only to an extent that your risk tolerance permits. Also understand that equity is a 10+ year idea. If you are looking for a quick buck, try your hand at something else!

Finally, my take on investing in India focussed MF in USA

India dedicated mutual funds are a good choice for US based investors who wish to invest in India, AND do not wish to fall into the trap of PFIC and tax issues. This is especially when funds like Matthews and Wasatch being good performing funds and focussed completely on Indian equity. Since Wasatch is a small cap oriented fund, you can divide your investment in Matthews and Wasatch in the ratio of 75:25. This will ensure that while you get a growth kick from small cap, you also diversify your fund manager risk in a small way.

Additional Reading: SEC guide on selecting the best mutual funds (PDF)

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com