Benami Prohibition Act is an Act which was enacted way back in 1988; however it did not have any teeth in terms of adjudication and other provisions so effectively it was a paper law.

In 2016, given the seriousness with which the present BJP government has been chasing black money, they’ve modified this 1988 Act and inserted some 70 odd sections relating to adjudication, appeals etc. to make it a full-fledged operational Act.

There are reports in the media that after demonetisation, the next step in the crackdown on black money will be benami property and in that backdrop, an understanding of this law is vital for any investor as well as professional.

Hence, in this post, I will touch upon the main provisions of the Act and its implications. I will try to keep it in FAQ style for easier understanding.

What is the objective of this Act?

For understanding any law, it is most important to first read the objective of the Act. W.r.t. this Act, the objective has been mentioned as “An Act to prohibit benami transactions and the right to recover property held in benami”

So, clearly, this Act aims to act as a deterrent to prohibit people from entering into benami transactions as well as gives right to the Government to confiscate benami properties.

What date it is effective from?

Despite the big amendments done in 2016, Benami Act is still effective from September 5, 1988.

What the new provisions have done is to create an adjudication and recovery machinery and by no means has this meant that benami properties prior to 2016 cannot come under the purview of the Act.

And this is one of the main reasons why Government did not repeal the 1988 Act and enact the new Act is that as per Article 20 of the Constitution, penal provisions cannot be made retrospective. Enacting a new Act would mean that those who’ve acquired benami properties before 2016 will get immunity and the Government did not want that to happen.

What is the definition of “benami property?

Benami property has been defined as “any property” which is the subject matter of benami transaction AND also includes proceeds from such property.

Now, this is a very wide definition and includes not just immovable property, but moveable property also like bank accounts, shares, vehicles, etc.

Important thing to note is that it includes “proceeds from such property” – this means that if Mr. A had INR 20CR of benami land since 1990 and after the launch of 2016 Act, he sells off the land and invests in shares of different companies, the shares will also constitute benami property and liable to penal provisions under the Act.

What is the definition of “benami transaction”?

Now, we come to the most important definition.

Benami Transaction is defined to be of any four types as follows:

- A transaction where property is transferred or held by a person while consideration is paid by another person AND the transferee/person holding the property holds the property for the benefit of such other person

- Transaction carried out in fictitious name

- Transaction where owner is not aware of, or denies ownership

- Transaction where person providing the consideration is not traceable

Now, ONLY for the category 1 above, following transactions are excluded:

- Property held by Karta/any member of an HUF, for benefit of other members of the family AND consideration has been paid out of the known sources of the HUF

- Person is standing in fiduciary capacity e.g. trustee, partner, director etc.

- Property held by an individual in name of spouse or in name of any child AND consideration has been paid out of the known sources of the individual

- Property held by an individual in name of brother or sister or a lineal ascendant/descendent as a joint owner in any document AND consideration has been paid out of the known sources of the individual

- Power of Attorney transactions provided stamp duty on such transaction has been paid and the contract has been registered.

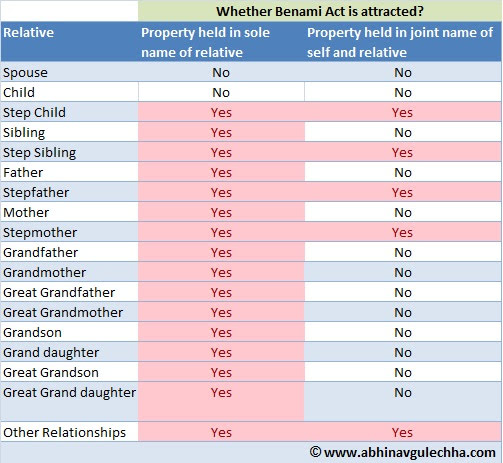

For the ease of understanding, check below table where I have given for each relationship, whether the Benami Act will be attracted or not:

What is the implication of a benami transaction?

The Act imposes following implications:

- Person entering into a benami transaction shall be punishable with imprisonment for a term which may extend to 3 years, OR fine, Or BOTH.

- No right to recover property in a suit

- Property will be liable for confiscation

- Prohibition on re-transfer of property (except where a property has been transferred in compliance to the 2016 Income Declaration Scheme which has already concluded)

It may be noted that in the landmark judgement in case of Bhim Singh vs. Kan Singh AIR 1980 SC 727, the Hon’ble Supreme Court had, after rollout of 1988 Act, prescribed some tests to decide whether the transaction “benami” or not.

The question that arises now in view of modified definitions after the 2016 amendment is – if transaction qualifies as benami under the amended law, will the tests laid down by SC be applied to check for any mala fide intention or straight away the penal implications of the new Act will apply.

This is a grey area however my personal view is that going by the rules of interpretation of statues, if something is very clearly mentioned in the statute, the reference to court judgement will not arise. Hence, if say a person has invested in the sole name of his brother, it will qualify as a “benami transaction” and the penal implications of the law will follow.

Also note that if the source of funds for the property involves “proceeds of crime” which include corruption, drug dealing, etc., in addition to implications under Benami Act, the provisions of Prevention of Money Laundering Act (PMLA), 2002 will also apply. If I have benami property, what are my options?

The definition of a benami property law is quite complicated, and at the same time, it gives a good lot of exemptions. First, you need to check and make sure whether the transaction actually falls in the definition of “benami transaction” or not.

For example, I’ve seen lot of people including NRIs who purchase flat in the name of wife in India – this may be for 2 reasons for this – one reason is that they genuinely want that no issues in transfer of ownership is caused in case of their death – other reason can be a mala fide intention to disclose rental income from flat in wife’s name and given that she does not have any other income in India, it becomes practically a tax free income (or so they think till they meet me!)

Now, please understand that in both these scenarios, it is NOT a benami transaction so the implications of Benami Act will not get triggered in any way. So, relax!

Yes, in second scenario where husband does not disclose rental income in his tax return and consequently does not pay tax, here the offence is of Income Tax Act and not Benami Act. As per the clubbing of income provisions of the Income Tax Act, husband is required to offer the income in his own return and pay applicable tax, however if he hasn’t then the tax, penalty and prosecution related provisions that will apply will be applicable under Income Tax Act and NOT Benami Act.

Another example: You have bought a property in your name for INR 1 crore. Out of this, INR 50 lacs were from white money and rest was from black money. Does it qualify as benami property? Answer is no, as property is purchased by you in your name.

Hence, this clarity is needed. If you are not clear, then you should not hesitate to seek a professional opinion from a CA before making any knee jerk reaction that can further complicate matters.

Now once we are clear that it is a benami transaction, let us come to the question whether it is a proper benami transaction and what are the options open in front of you.

Here, we can note that the government had, in mid 2016 rolled out the Income Declaration Scheme (IDS) (Read my post: 2016 Income Declaration Scheme: Should you opt for it?) where it was provided that income disclosed under the scheme will not be treated as benami transaction. I had expressed a strong view then that people should pay the 45% tax & use this scheme & come clean.

Unfortunately, this window has now been closed.

It may also be noted that in the wake of demonetisation, Government has rolled out another income disclose scheme by the name Pradhan Mantri Garib Kalyan Yojana (PMGKY) and this scheme is presently running. However, this scheme very clearly does not allow any income liable under Benami Act to be disclosed. So, in my view, this option is also not available.

It may also be noted that given the seriousness of the black money economy, the Act does not give an option of compounding of offence as possible in case of FEMA.

So, I cannot think of any legal solution here.

Also, there is no way out in terms of gifting or selling the property and investing elsewhere as it will still constitute benami property.

However, w.r.t. undisclosed income arising from the property under Income Tax Act, it is a grey area whether one should go ahead to regularise it with filing the income in tax returns correctly as well as seeing if past 2 year returns can be revised to ensure that the income not disclosed is disclosed now.

Reason is that the income tax department is the adjudicating authority under Benami Act also, so there might be a situation that any fresh income disclosures can lead you to get a notice under Benami Property Act.

Hence, advised to tread with caution and consult a professional CA.

Does benami property outside India come within the scope of this law?

The definition of “benami property” as per the Act is very wide and includes such property outside India. However, during debate on this Bill in the Parliament, the Finance Minister has clarified that since there is a separate law in the form of Black Money Act enacted to deal with such assets, such assets will be fall under purview of that law and not this law.

However, a grey area exists where benami property outside India is sold and proceeds are invested to buy a property in India – in such a situation, which law will apply – Black Money Act or Benami Act?

Also read: Black Money Act: An Analysis

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com