It is well known that an NRI can invest in India via a portfolio investment scheme (PIS) route i.e. by purchasing and selling shares on a stock exchange through a Depository Participant. As regards PIS investment, I have already written a detailed post on it, you can refer it here: How returning NRIs can invest in Indian equity markets

However, many a times NRI are keen to invest in a particular startup or a business of a relative or a friend in India which can be a company, or a LLP, or a firm or a proprietary concern, as the case may be.. That particular investment is known as “direct investment” and there are separate and more extensive FEMA rules applicable to such investments.

It may also be noted that NRI investment in Indian companies/concerns constitute a “capital account transaction”. So, unless the investment is permitted under the various notifications of FEMA, the transaction is not allowed under FEMA (also read: Capital and Current Account Transaction as per FEMA).

In such a case, you can approach the relevant compounding authority in RBI to see if the offence can be regularized by paying a penalty – read this post for more info on the same: How Resident/NRIs can resolve FEMA contravention

In this post, I will be discussing the FEMA rules and compliances around such direct investments by NRI in Indian concerns. To clarify, I am only presenting a broad overview of the rules and compliances that are required in such transactions however a specific and though fact evaluation should be carried out in each case before coming to any conclusion.

Applicable FEMA Regulations on direct investment by NRI in Indian company

Direct investment can be in an Indian company, LLP, partnership or a proprietary concern

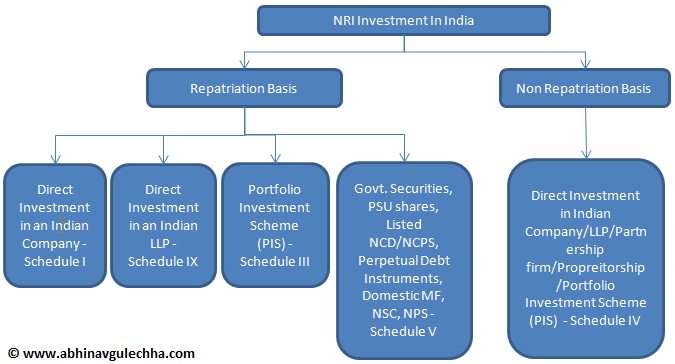

As regards investment in Indian company or an LLP, the frame for reference is Notification 20/2000 dated 03/05/2000 i.e. FEM (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2000. This notification has various Schedules which discuss the rules for different types of investors. Following Schedules are applicable to NRI investment:

- Schedule 1: Purchase by a person resident outside India of shares/convertible debentures/warrants of Indian company

- Schedule 3: Acquisition of securities or units by NRI on repatriation basis under Portfolio Investment Scheme (PIS)

- Schedule 4: Acquisition of securities or units by a NRI on “non-repatriation basis”

- Schedule 5: Purchase and Sale of Securities other than shares/convertible debentures/warrants by a person resident outside India

- Schedule 9: Scheme for Acquisition/Transfer by a person resident outside India of capital contribution or profit share of LLP

Before we move ahead, please note that FEMA 20 is one big regulation, and quite a complex one with a lot of amendments every year. All relevant updates are available on RBI website here. For ease of understanding, I have tried to capture the basic structure of the FEMA 20 below:

It may also be noted that apart from NRI, separate rules exist in FEMA 20 for “entities” like foreign companies, institutional investors (FII), qualified foreign investors (QFI) etc. For ease of understanding, I am only focusing on NRI investment in this post & will take up rules for other entities in series of separate posts.

As regards NRI investment in partnership or a proprietary concern, apart from FEMA 20, Notification 24/2000 dated 03/05/2000 i.e. FEM (Investment in Firm or Proprietary Concern in India) Regulations, 2000 is also applicable. That is a comparatively small regulation & I will cover it in a separate post. The discussion in this post will be primarily focused on NRI investment in Company/LLP structure only.

Repatriability of Investment

The first thing NRI needs to check is whether investment is being done on a repatriation basis (NRI wants to repatriate investment/profits at a later date out of India) or on a non-repatriation basis (intention to keep investment & profits from business activity in India only) – here, it is important to know that while an investment in repatriation basis is a “debt” for India as a country, the sectoral caps/conditions/approvals etc. are far more than investment being done on a non-repatriable basis. It may also be noted that there is NO LIMIT/CAP on investment made on non-repatriable basis and it is treated at par with a domestic investment.

Further discussion in this post will be for a situation where investment is sought to be made on a repatriation basis, as covered primarily by Schedule I.

Investee Company should be carrying out a permitted activity

Annex A to Schedule I of Notification 20 specifies following activities where foreign investment is not at all possible. These activities are lottery, gambling, chit fund, Nidhi Company etc. Investment in any such company will be a direct contravention of FEMA.

Clarification as regards nidhi company: Given the high propensity among South Indian NRIs to invest in chits, the investment per-se has been allowed (not qualifies as FDI) however investment in an Indian company running chit fund business is still not allowed.

Investment should satisfy the sectoral cap/conditions, if any

For activities which are not on the prohibited list as above, it needs to be checked where the sector in which the company falls is under automatic route or approval route. Annex B lists down the foreign investment cap and entry route (automatic/approval) in various sectors.

Automatic route means no separate approval from Government is required.

Approval route means you need to get a prior approval the Department of Industrial Policy and Promotion (DIPP) before making the investment – note that the erstwhile FIPB has now been abolished – read this news article

So, first of all, before investment is done, it is important to check what is the nature of activity/business of investee company. However, liberalization over the years has ensured that more than 80% of activities/sectors are under automatic route.

- Schedule 1: Onus of compliance with sectoral caps/conditionalities as mentioned in Schedule 1 is with the investee company

- In certain situations like company engaged in prohibited activities or inviting FDI in excess of sectoral cap, prior Government approval is required.

NRI should be eligible for investment

All non-residents are permitted to invest under Schedule I. There are certain restrictions for citizens of Bangladesh & Pakistan – for the sake of brevity, I am not going into that in this post. Unincorporated entities are not permitted to invest after the 2002 stock market scam.

However, as regards NRI, definition of NRI has been amended in Feb 2016 – Reg. 2 (viia) in FEMA 20 contains a new definition of NRI for purpose of eligibility to invest as follows:

“Non-Resident Indian (NRI) means an individual resident outside India who is citizen of India or is an ‘Overseas Citizen of India’ cardholder within the meaning of section 7(A) of the Citizenship Act, 1955.”

This definition implies that as a non-resident, if you continue to remain an Indian citizen, fine. However, if you’ve obtained citizenship of any other country, in that case if you have not become an OCI, you are not eligible to invest.

Hence, an NRIs who has foregone Indian citizenship (for e.g. a USC) and now planning to invest in Indian startup must know that he need to get the OCI before investing in India else his investment can be treated as being in contravention of FEMA.

Eligible investee entities for NRI to invest

Under FEMA, NRI can invest in following entities:

- Indian Company

- Indian LLP

- Indian Partnership firm

- Indian Sole Proprietary Concern

As regards investment in a trust, it may be noted that per-se FEMA does not recognise a trust as a separate entity. In my view, it is better to obtain a formal clarification from RBI before proceeding to invest in a trust.

Also Read: Taxation of Private Trusts in India

As regards investment in partnership or a proprietary concern, I will cover it in a separate post. The discussion in this post will be limited to NRI investment in Company/LLP.

Eligible securities through which NRI can invest

This will depend on whether investment is proposed to be made on a repatriable or on a non-repatriable basis.

As regards investment on a repatriation basis, Schedule 1 is applicable and NRI can invest ONLY by way of equity shares, warrants and fully convertible debentures.

Rules clarify following points:

- Share premium will also qualify as foreign direct investment (FDI) for minimum capitalization purpose, if any, mandated under these Rules.

- Equity/preference shares can be issued by Indian company to a non-resident as against royalty/ECB/import of goods/funds payable to such non-resident/share swap etc.

- Rules also allow issue of partly paid equity shares.

Rules on pricing of shares

In case of equity shares for purpose of Schedule 1, pricing cannot be less than the following:

- Listed company: Price worked out in accordance with SEBI guidelines

- Unlisted company: As per any internationally accepted methodology and as certified by CA/SEBI Registered Merchant Banker.

An exception is there w.r.t. shares issued or subscription to Memorandum of Association – in such case, FEMA allows issue of shares at face value.

Also, in case of issue of preference shares, a cap exists whereby the rate of dividend cannot exceed 300 basis points over SBI Prime Lending Rate.

Mode of payment of consideration by NRI

Regulations require the payment for shares to come from inward remittance through a banking channel or by way of debit to NRE/FCNR account or a non-interest bearing escrow account.

Regulations further say that if the shares etc. are not issued within 180 days of receipt of funds, then the same will have to be refunded.

Reporting Requirements applicable to Indian Company

Indian company need to do reporting to RBI at the following stages:

- Receipt of consideration: File “Advanced Reporting Form” to AD bank within 30 days from receipt of consideration along with copy of FIRC, KYC and Government approval, if any.

- Issue of shares: File Form FC-GPR to AD bank along with CS certificate + CA/Merchant Banker certificate within 30 days from issue of shares.

- Annual Basis: Submit “Annual Return of Foreign Liabilities and Assets” to RBI on or before July 15 (only applicable where FDI has been received in a particular year)

Transfer of shares: Resident to Non-Resident

- For sectors where Government approval is required, such transfer shall be subject to Government approval.

- For sectors under automatic route with conditionalities, the transfer will be subject to fulfillment of those conditionalities

- Resident transferor is required to report the details in Form FC – TRS to the AD Bank within 60 days of date of receipt of consideration

- Shares cannot be issued below the pricing as per SEBI guidelines/internationally accepted pricing methodology

- Max. 25% of total consideration can be paid by the buyer on a deferred basis within 18 months from the date of the transfer agreement

Transfer of shares: Non-Resident to Resident

- Resident transferee is required to report the details in Form FC – TRS to the AD Bank within 60 days of date of payment of consideration

- Shares cannot be issued above the pricing as per SEBI guidelines/internationally accepted pricing methodology

- Max. 25% of total consideration can be paid by the buyer on a deferred basis within 18 months from the date of the transfer agreement

Grey Areas in FEMA 20:

- It may also be noted that for investments qualifying in Schedule 4 (investment on non-repatriation basis), investment by a company, trust or partnership firm incorporated outside India and controlled by NRI have also been permitted. However, no criteria have been defined as to what constitutes “control”.

- Can NRI who is a settlor or a trustee or a beneficiary in an offshore private trust invest through that trust in India? Nothing is expressly permitted by the regulation hence my view is NO. A clarification should be obtained before making investment in trust’s name in a company in India.

FEMA Compliance Checklist for Indian Company accepting NRI investment

- Is the activity of the Indian company allowed for FDI purposes?

- Is the FDI under automatic route or approval route?

- Whether all conditionalities, approvals and sectoral caps complied with in accepting such investment?

- Is the NRI planning to invest is an Indian citizen and if no, does he possess OCI? A self-declaration/OCI card copy can be taken

- Will the investments be on a repatriable or a non-repatriable basis?

- Has proper valuation of shares been done and appropriate CA/Merchant Banker certification obtained?

- Preserve copy of Foreign Inward Remittance Certificate (FIRC) as proof of receipt of funds for the purpose of issue of shares.

- File “Advanced Reporting Form” to AD bank within 30 days from receipt of consideration along with copy of FIRC, KYC and Government approval, if any.

- Ensure that shares etc. are issued to the NRI within 180 days of receipt of funds

- File Form FC-GPR to AD bank along with CS certificate + CA/Merchant Banker certificate within 30 days from issue of shares.

- On or before July 15th, submit “Annual Return of Foreign Liabilities and Assets” to RBI

NRI Investment in Indian LLP

- NRI (except Citizens of Pakistan and Bangladesh) can invest in LLP by way of capital contribution or profit share.

- Contribution to the capital of an LLP will constitute an “eligible investment” under the scheme. However, Investment by way of ‘profit share’ will fall under the category of reinvestment of earnings.

- LLP is allowed to accept FDI only if FDI is permitted under the automatic route where 100% FDI is allowed through the automatic route and there are no FDI linked performance conditions.

- FDI in LLP is subject to the compliance of the conditions of Limited Liability Partnership Act, 2008.

- Pricing wise, FDI would have to be more than or equal to the fair price as worked out with any valuation norm which is internationally accepted market practice and a valuation certificate issued by a CA/ Cost Accountant or by an approved valuer

- In case of transfer of capital contribution / profit share from a resident to a non-resident, the transfer shall be for a consideration equal to or more than the fair price of capital contribution / profit share of an LLP.

- In case of transfer of capital contribution / profit share from a non-resident to resident, the transfer shall be for a consideration which is less than or equal to the fair price of the capital contribution / profit share of an LLP.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com