Over the years, in keeping up with liberalization and promotion of foreign trade, RBI has liberalised the rules on allowing Indian companies/resident individuals to set up companies and make investments abroad, which is terms as overseas direct investment (ODI).

Today, I am going to discuss and present a broad overview of those rules which an Indian company or resident individual must keep in mind while making such investments abroad.

Asides, for financial planning aspects of overseas investments by resident individuals, you can check this post: International Investing by Resident/NRI: An Analysis

Applicable regulation

The applicable regulations on the point are as follows:

- FEM (Transfer or Issue of any Foreign Security) Regulations, 2004 – Notification 19/2000 – RB dated 03/05/2000

- Master Direction – Direct Investment by Residents in Joint Venture (JV) / Wholly Owned Subsidiary (WOS) Abroad dated Jan 1, 2016 Link

- Master Direction – Liberalised Remittance Scheme (LRS) Link

- Applicable AP DIR circulars on this matter as issued from time to time

Basic principles on ODI investment

- ODI investment is a capital account transaction. Hence, it is permitted to the extent it is allowed by RBI vide the above applicable regulations – if the investment you’re planning to make is not covered specifically with these regulations, it is better to seek specific approval from RBI

- RBI’s focus while allowing ODI investment is to ensure that a) investment is for a “bona-fide” business activity outside India and b) the Indian company is well capitalized to honour its commitments under foreign laws w.r.t. the overseas enterprise.

- ODI is foreign exchange going out of the country – so, RBI will not allow it (where approval is to be sought) unless the investment in some way furthers interests of India as a nation.

- Again, since ODI is foreign exchange going out of the country, RBI is very clear that in case of disinvestment, proceeds should be brought back to the country and not shifted to any other country

Basic structure of ODI

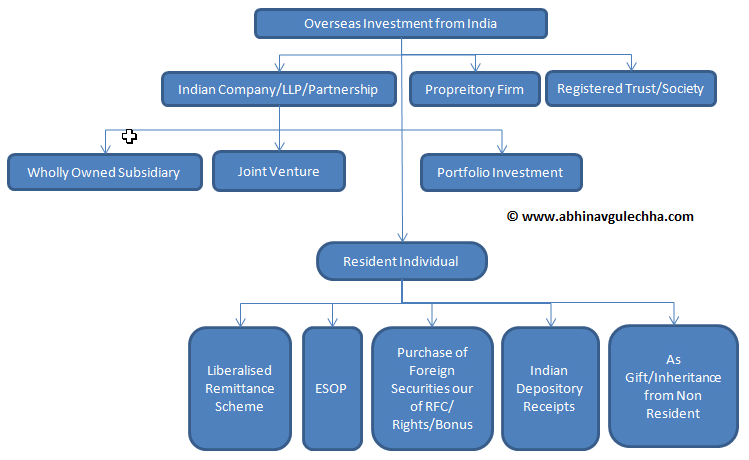

FEMA allows Indian entities (company, trust, society, partnership firm, LLP) as well as residents to invest outside India. This investment can be a “direct investment” in a bona fide business activity or by way of purchase of shares etc. of foreign companies. There are detailed rules for each category.

For ease of understanding, structure of ODI investment is explained below:

Before we proceed: Important point w.r.t. abuse of ODI facility

Lot of Indian companies have tried to misuse the ODI permission to set up dummy subsidiaries or highly complex step down structures outside India (especially in tax havens like UAE and BVI) with an intention to either shift taxable profits out of India or to launder proceeds of crime. Also, companies have sent funds vide ODI and brought back as FDI to take certain tax benefits/concessions (known as “round tripping”).

On one side, we have OECD BEPS Action Plan, GAAR and PMLA provisions to take care of such tax evasion and money laundering; RBI has also over the years increased surveillance on such abusive practices by way of increased compliance/reporting requirements.

It is especially notable that by way of Finance Act, 2016, certain sections of FEMA (Section 13 (IA) and 37A) have been amended which effectively mean that in case of a mere “reason to believe” that a FEMA contravention exists w.r.t. investments outside India, Enforcement authorities will have the power to seize equivalent assets located in India and also direct prosecution of guilty person. This is a very important amendment which turns an otherwise benevolent regulation into a draconian one.

Indian Company/Partnership/LLP – Overseas WOS/JV

Main conditions for ODI

Indian Company/Partnership/LLP can invest either by way of Wholly Owned Subsidiary (WOS)/Joint Venture (JV) or by way of portfolio investment outside India.

Indian company can create a WOS outside India under automatic route (i.e. without prior approval of RBI) provided the following conditions are satisfied:

- Total financial commitment of Indian Party does not exceed 400% its net worth. Note that there are detailed norms on what constitutes “financial commitment”

- Note: Effective July 03, 2014, any financial commitment (FC) exceeding USD 1 (one) billion (or its equivalent) in a financial year would require prior approval of RBI even when the total FC of the Indian Party is within the eligible limit under the automatic route (i.e., within 400% of the net worth as per the last audited balance sheet)

- The Indian Party should not be on the Reserve Bank’s Exporters’ caution list / defaulters list

- All transactions relating to a JV / WOS should be routed through one branch of an AD bank to be designated by the Indian Party.

- Valuation requirement: In case of partial / full acquisition of an existing foreign company, where the investment is more than USD 5 million or by way of share swap, valuation of the shares of the company shall be made by a Category I Merchant Banker or an Investment Banker / Merchant Banker outside India registered with the appropriate regulatory authority in the host country; and, in all other cases by a Chartered Accountant or a Certified Public Accountant.

- In case of investment by a registered Partnership firm, where the entire funding for such investment is done by the firm, individual partners need to hold shares on behalf of the firm in the JV / WOS if the host country regulations or operational requirements warrant such holdings.

- Indian Party may acquire shares of a foreign company in exchange of ADRs/GDRs issued to the latter in accordance with the Scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares (through Depository Receipt Mechanism) Scheme, 1993 – separate conditions are prescribed for ADR/GDR funded investments.

- Investments / financial commitments in Nepal are permitted only in Indian Rupees.

- Investments / financial commitments in Bhutan are permitted in Indian Rupees as well as in freely convertible currencies.

- All dues receivable on investments (or financial commitment) made in freely convertible currencies, as well as their sale / winding up proceeds are required to be repatriated to India in freely convertible currencies only.

- Investment/ financial commitments by an Indian Party are not permitted in an overseas entity located in the countries identified by the Financial Action Task Force (FATF) as “non co-operative countries and territories” as per list available on FATF website

- Investments / financial commitments in Pakistan by Indian Parties are permissible under the approval route.

- Investments (or financial commitment) in unincorporated / incorporated entities overseas in the oil sector (i.e. for exploration and drilling for oil and natural gas, etc.) may be permitted by AD Category – I bank, without any limit, provided such investments are approved by the competent authority and Board Resolution copy etc. are furnished.

Mode of Funding

Investment (or financial commitment) in an overseas JV / WOS may be funded out of one or more of the following sources:

- drawal of foreign exchange from an AD bank in India;

- capitalisation of exports;

- swap of shares (valuation as mentioned in para B.1 (e) above);

- proceeds of External Commercial Borrowings (ECBs) / Foreign Currency Convertible Bonds (FCCBs);

- in exchange of ADRs/GDRs

- balances held in EEFC account of the Indian Party and

- proceeds of foreign currency funds raised through ADR / GDR issues

Conditions w.r.t. sale of shares of a JV / WOS

FEMA rules allow Indian Party to transfer by way of sale to another Indian Party which complies with FEMA 19 or to a person resident outside India, any share or security held by it in a JV or WOS outside India without RBI approval subject to the following conditions:

- Sale does not result in any write off of the investment (or financial commitment) made.

- Sale is effected through a stock exchange where the shares of the overseas JV/ WOS are listed

- If the shares are disinvested by a private arrangement, the share price is not less than the value certified by a CA/ CPA

- Indian Party does not have any outstanding dues by way of dividend, technical know-how fees, royalty, consultancy, commission or other entitlements and / or export proceeds from the JV or WOS;

- Overseas concern has been in operation for at least one full year and the Annual Performance Report together with the audited accounts for that year has been submitted to RBI

- Indian Party is not under investigation by CBI / DoE/ SEBI / IRDA or any other regulatory authority in India

- Indian Party submits details of such disinvestment through its designated AD category-I bank within 30 days from the date of disinvestment.

Indian Company/Partnership/LLP – Portfolio Investment

Listed Indian companies are permitted to invest up to 50 per cent of their net worth in (i) shares and (ii) bonds / fixed income securities, rated not below investment grade by accredited / registered credit rating agencies, issued by listed overseas companies. Separate rules exist for mutual funds and venture capital companies.

Proprietorship /Unregistered Partnership firm

A Proprietorship /Unregistered Partnership firm can make an ODI only if it satisfies following conditions:

- Firm is classified as ‘Status Holder’ as per the Foreign Trade Policy issued by the Ministry of Commerce and Industry, Govt. of India from time to time;

- It has a proven track record, i.e., the export outstanding does not exceed 10% of the average export realisation of the preceding three years and a consistently high export performance;

- AD bank is satisfied that the firm is KYC (Know Your Customer) compliant, engaged in the proposed business and has turnover as indicated

- It has not come under the adverse notice of any Government agency and does not appear in the exporters’ caution list of RBI

- Amount of proposed investment (or financial commitment) outside India does not exceed 10 per cent of the average of last three years’ export realisation or 200 per cent of the net owned funds firm in India, whichever is lower.

Trust

- The Trust should be registered under the Indian Trust Act, 1882

- The Trust deed permits the proposed investment overseas

- The proposed investment should be approved by the trustee/s

- The AD Category – I bank is satisfied that the Trust is KYC (Know Your Customer) compliant and is engaged in a bona fide activity

- The Trust has been in existence at least for a period of three years

- The Trust has not come under the adverse notice of any Regulatory / Enforcement agency

Society

- Society is registered under the Societies Registration Act, 1860.

- The Memorandum of Association and rules and regulations permit the Society to make the proposed investment which should also be approved by the governing body / council or a managing / executive committee.

- The AD Category – I bank is satisfied that Society is KYC (Know Your Customer) compliant and is engaged in a bonafide activity;

- The Society has been in existence at least for a period of three years;

- The Society has not come under the adverse notice of any Regulatory / Enforcement agency like the Directorate of Enforcement, CBI etc

Resident Individual– Under Liberalised Remittance Scheme (LRS)

I’ve discussed LRS in a detailed post here: Liberalised Remittance Scheme (LRS) under FEMA: Analysis & Issues

It may be noted that LRS lists certain specific investments only as follows:

- Opening of bank account

- Purchase of property

- Making investments – acquisition and holding shares of both listed and unlisted overseas company or debt instruments

- Acquisition of qualification shares of an overseas company for holding the post of Director

- Acquisition of shares of a foreign company towards professional services rendered or in lieu of Director’s remuneration

- Investment in units of Mutual Funds, Venture Capital Funds, unrated debt securities, promissory notes

- Setting up WOS/JV (with effect from August 05, 2013) outside India for bona fide business

It may specifically be noted that RBI has changed its position on quite a few issues over the years – for example, at one point, RBI had stopped allowing individuals from investing in WOS/JV without a clear directive/circular and resumed in 2013 – issue is – what happens to those who have floated WOS outside India before August 05, 2013 going by wordings in extant LRS circular- representations have been made on this issue Link

Resident Individual – Gift/Inheritance from NRI

FEMA rules allow resident to acquire foreign securities as a “gift” or “inheritance“from a person resident outside India.

From an Indian income tax perspective, in case of gift of securities, a proper gift deed should be executed to signify intention of gift – also read: Gift by NRI to Resident: Also be aware of Section 68 of ITA

Issue: What if a resident holding shares of say Apple Inc. in USA wants to gift it to another resident – is this allowed? Or if a resident leaves a will and after his death, shares of Apple Inc goes to another resident relative? Can FEMA override the succession law in such case?

Resident Individual – ESOP

There can be two scenarios here as follows:

- Cash ESOPs (where employee needs to pay at the exercise of option)

- Cashless ESOPs (where employee need not pay anything – at the date of exercise itself, the shares are sold and difference between stock price and exercise price is paid out to employee)

As regards cashless ESOP, no RBI permission is required.

As regards cash ESOPs, following conditions apply:

- Person should be employee/ director of Indian office/branch of a foreign company/ subsidiary in India of a foreign company/ Indian company in which foreign company has an equity holding

- Shares under the ESOP Scheme are offered by the issuing company globally on a uniform basis

- Indian company submits annual Return to RBI

Resident can transfer the shares acquired by exercise of ESOP provided that the proceeds thereof are repatriated to India not later than 90 days from the date of sale.

As regards foreign company repurchasing the shares, it is allowed provided:

- Shares were issued in accordance with the Rules / Regulations framed under FEMA

- Shares are being repurchased in terms of the initial offer document

- Annual return is submitted to RBI

Also read: Taxation of ESOP/ESPP/RSU/SAR in India

“Not Permanently Resident” Individual (Expat) – From foreign sources outside India

There is a specific provision for not permanently resident individuals (i.e. those who are on employment visa and for a specific duration of work not > 3 years) – for such persons, it is allowed that they can purchase foreign security from their “foreign currency resources)

Important to note here that this regulation does not say anything about Indian income – however, if you see Remittance of Assets regulation, it allows for remittance of full net salary – read more here: Remittance facilities to NRI & Expats under FEMA

Issue: FEMA 19 allows for purchase of foreign security – word “security” has not been defined in this regulation, so reference has to be w.r.t. FEMA – security does not include a bank account or say a property – in this situation, will an expat working in India be allowed benefit of LRS facility for permitted capital account transactions like opening bank account and purchasing property (of course within LRS limit) or is It that till the time expat is in an NPR of India, restrictions apply on him for those purchases. No clear answers here. In my view, NPR falls in definition of resident should also be allowed. Better to seek a clarification from RBI before proceeding.

Also read: How NRI/Expat/Seafarer can “plan” their India stay legally & reduce tax

Resident Individual – Other permissible investments

Apart from the above, residents can also subscribe to Rights/bonus shares out of existing shares held outside India and also invest from RFC account (permitted up to the LRS limit)

FEMA Compliance Checklist for ODI

Under the Rules, Indian Party/ Resident Individual which has made an ODI has following compliance obligations:

- Receive share certificates or any other document as an evidence of investment in the foreign entity to the satisfaction of the RBI within six months

- Repatriate to India, all dues receivable from the foreign entity, like dividend, royalty, technical fees etc., within 60 days

- Submit to RBI, through the AD Bank, every year on or before December 31, an Annual Performance Report (APR) in Part II of Form ODI in respect of each JV or WOS outside India, and other reports or documents as may be prescribed by RBI from time to time. The APR, so required to be submitted, has to be based on the audited annual accounts of the JV/WOS for the preceding year, unless specifically exempted by RBI.

- Submit Annual Return on Foreign Liabilities and Assets (FLA) directly by all the Indian companies which have received FDI and/or made FDI abroad (i.e. overseas investment) in the previous year(s) including the current year, to the Director, External Liabilities and Assets Statistics Division, Department of Statistics and Information Management (DSIM), Reserve Bank of India.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com