In case of cross border transactions, there may be a situation that tax is withheld or paid in other country however the transaction is also taxable in India. In such situations, Section 90 and 91 of Income Tax Act (ITA) allows credit of such foreign tax however there was a lack of procedural clarity on how to claim the credit.

In a welcome move, the Central Board of Direct Taxes (CBDT) has, in 2016, issued Rule 128 in the Income Tax Rules which clarifies on the applicability and procedure of claiming Foreign Tax Credit (FTC). In this post, I am presenting an overview of FTC rules and some grey areas/issues that remains to be addressed.

Who can claim FTC?

Only a resident assessee can claim. The assessee can any person – individual/firm/company etc.

Question arises – can resident mean RNOR also? In my view, yes. However, given that under RNOR phase, foreign income is exempt, the question is more of an academic one.

Also read: Returning NRI having foreign income/assets should make full use of RNOR phase

Credit is available for what?

This is important.

Previously, there was a lack of clarity on whether the tax credit is to be paid where tax is merely withheld, or where the tax is actually paid and/or assessment is completed.

The Rules put an end to this controversy by saying that credit is available for tax paid or withheld, both.

So, imagine a resident investing in equities in USA and receives dividend income from such shares. Tax is withheld on that income in USA. The income is taxable in India. While paying tax in India, the resident can deduct the tax withheld in USA as per the Rules.

However, in one recent decision of Vijay Electricals [2015] 54 taxmann.com 19 (iTAT), it has been held that the word “paid” for the purposes of Section 90 of ITA includes “incurred” – so, even if the tax liability is provided for in books but not “Actually paid”, credit for such tax so provided should be allowed if such income is offered to tax in India. In my view, this decision stays relevant even under the new FTC rules and “paid” should be construed in the strict sense of the term.

Credit can be set off against which Indian tax liability?

Rules specifically provide that credit shall be available only against the amount of tax, surcharge and cess payable under ITA but not in respect of any sum payable by way of interest, fee or penalty.

At what rate the foreign tax credit will be allowed?

The Rules say the following:

- Where DTAA exists: Tax covered under the said agreement;

- Other case: Tax payable under the law in force in that country which is in the nature of income tax

So, before claiming FTC, it is critical to check whether a DTAA is available. In case DTAA is available, one has to study the DTAA clauses to see whether the tax claimed as deducted/paid in that country, is covered.

Classic example is state tax and medicare tax in USA – if you analyse India USA DTAA, these taxes are out of the purview and only federal tax is covered. Hence, for the purpose of claiming FTC, you can only claim credit of federal tax, nothing more.

However, if there is no DTAA in place, then one has to see the “substance” of the foreign tax – if it is in nature of income tax, it can be claimed.

So, one has to keep these finer issues in mind before claiming FTC to avoid any tax enquiries at a later stage.

Is there a condition that credit is allowed if tax is paid in the previous year itself?

No, there is no such condition. So, if tax is paid in USA in FY 2013-14 however income (on which tax is charged in USA) is offered to tax in India in FY 2016-17, then credit can be claimed for such foreign tax in FY 2016-17 return. There is also no mention of a time limit till when the credit is available.

This is in consonance with judgment in Petroleum India [2013] 29 taxmann.com 250 (Bom HC) where it was said that foreign tax need not have been paid in the previous year (for Indian tax purposes).

What if income is offered to tax in India today and tax incidence is deferred in foreign country?

This area has been left unaddressed by the rules. Going by the present shape of Rules, if the foreign taxation on the income is deferred, the credit of taxes cannot be pre-claimed in Indian assessment on a notional or an estimated basis. There is no such facility.

This does not help returning NRIs from USA who have 401K accounts – while income is to be declared and tax paid every year in India, tax has to be paid in USA only at the time of withdrawal after 59.5 – by that time, Indian tax assessment window will be already over. The only solution then, it seems, is to disclose the income in India on “cash” basis of accounting – but that has its own share of risks – I’ve discussed this issue in detail in this post: Taxation of 401K/IRA in India

What if assessee has disputed the tax payment in foreign country?

It may happen that assessee has paid taxes In USA in protest and has preferred an appeal against such a levy. In such cases, Rules say that he cannot take credit on such portion of tax which is disputed.

However, rules provide if the assessee within six months from the end of the month in which the dispute is finally settled, furnishes evidence of settlement of dispute and an evidence to the effect that the liability for payment of such foreign tax has been discharged by him and furnishes an undertaking that no refund in respect of such amount has directly or indirectly been claimed or shall be claimed.

What if assessee has paid tax (or tax is deducted) in foreign country but has claimed a refund of such tax?

It may so happen that payer has withheld tax from some income in say USA of a resident Indian and such income is also liable to tax in India.

In such case, though the word “dispute” is not defined in the Rules, on a plain reading, such a case does not fall within meaning of the word “dispute”

Rules do not say anything about what to do in such a case. However, prudence demands that assessee should refrain from claiming credit of such tax in Indian tax return.

Also, in case a tax refund is received in foreign country which has already been claimed in a particular assessment year in India, details need to be disclosed in Schedule FA – I’m not sure as to what is the financial outcome of such disclosure.

How is the FTC for a particular year computed?

Rules say the following:

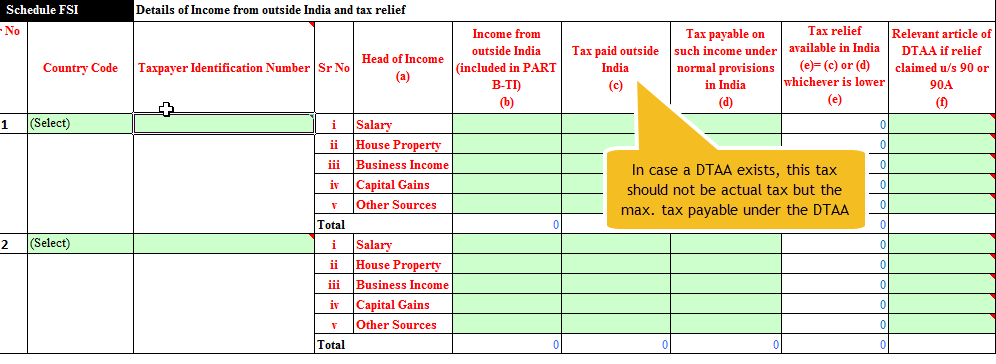

- Credit shall be computed “separately” for each source of income for each country

- Credit shall be the lower of the tax payable under the Act on such income and the foreign paid on such income (to the extent allowed under DTAA if it exists)

- Foreign currency to be converted at the telegraphic transfer buying rate (TTBR) on the last day of the month immediately preceding the month in which such tax has been paid or deducted

If we see Schedule FSI, details have been arranged in the same manner. Care has to be taken to see that if DTAA exists, instead of tax paid, the max. tax payable as per DTAA is inputted in that column – refer image below.

In a specific case where DTAA does not exist, there are judgments which say that rate of tax paid outside India will be considered as the average rate of tax paid outside India on the total taxable income attributable to such foreign operations – Hindustan Construction [2013] 29 taxmann.com 82 (Mum AT)

As regards taxes which do not form part of DTAA (for example, state tax in USA), instead of considering only federal income tax as per DTAA, assessee has the option to claim benefit u/s Section 91 for computation of FTC and claim credit of such FTC – this is as per judgment in Tata Sons [2011] 43 SOT 27 (ITAT)

Should FTC be considered in Advance Tax computation?

New Rules are silent on this. If we see advance tax provisions in Section 207-209 of ITA, they are also silent. However, interest chargeability provisions in Section 234B and 234C specifically allow for FTC. Hence, in my view, FTC can and must be considered for advance tax computation process.

Can FTC be on an “estimated” and not on a “paid basis for the calculation? I think yes.

Is there any documentation needed to claim FTC?

Before the Rule 128 was released, there was no as such a documentation requirement for FTC claim. However, from a prudence and scrutiny point of view, the withholding tax certificate issued by the deductor in foreign country along with the Tax Residency Certificate (TRC) (in case DTAA benefit was being claimed) was recommended.

However, now in addition to above, as per Rule 128, Form 67 has to be furnished which contains details of income and such foreign tax – it is not clear as to how to furnish this form – as on the date I am writing this post, income tax e-filing website has also not enabled filing of this form electronically. So, the position as of now may be to file and keep it for record and produce to tax officer in case of scrutiny.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com