Form 15CA/CB compliances by NRI: Procedure and Issues

Assume you are an NRI based out USA and you’ve sold property in India and after deduction of applicable TDS by the buyer, the proceeds are in your NRO account.

Now, you want to transfer the amount back in USA.

As per Indian Income Tax Act, any payment to a non-resident as per the Income Tax Act requires a person to deduct TDS as per Section 195 and file Form 15CA Form 15CB in accordance with Rule 37BB of the Income Tax Act.

Hence, in such a situation, the bank will not accede to your request you wire your funds back to USA unless you provide them Form 15CA and Form 15CB.

In this post, I am going to discuss that procedure and practical issues in Form 15CA Form 15CB so that as an NRI, you can seamlessly transfer your rightful money out of India.

Basic Intention of Form 15CA/CB compliance

Before going into specifics, it is very important to understand the logic – why does the Government want hapless citizens, who are already burdened with a lot things, to file forms with banks to make payment to a non-resident?

Reason is simple.

Government does not trust a non-resident with respect to his compliance to the tax provisions and wants that instead of relying on him to deposit his due tax in India, tax should be deducted BEFORE the funds move out of India.

Hence, Government wants to make sure that the person paying any amount to non-resident does 2 things -a) deduct TDS at applicable rate and deposit in Government account and b) file certain forms with the bank to confirm that applicable tax has been deducted, before the money moves out of India.

Now, Government cannot do this itself. So, it has imposed responsibility on banks to do it, which in turn require a CA to certify on this before processing the transaction.

With this understanding, let us proceed to the specifics of this procedural compliance.

Who need to file Form 15CA/CB?

Following persons need to file these forms:

- Any person who wants to remit any amount to a non-resident (not being a company) has to file Form 15CA/CB to the concerned bank from which he wants to transfer the account.

- Any person who is a non-resident as per Income Tax Act and wants to transfer any funds from his NRO bank account to NRE bank account

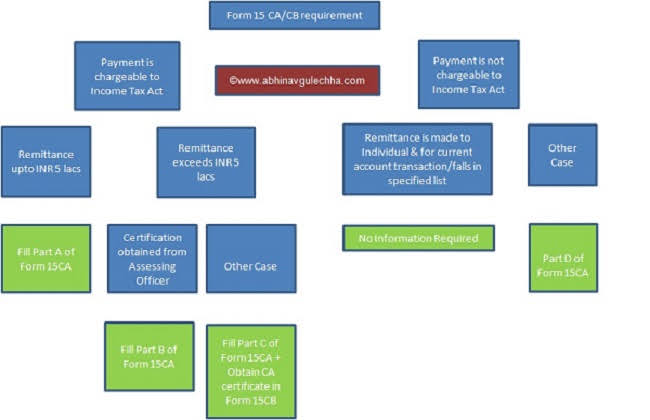

However, exact rules on which form will be applicable are contained in Rule 37BB of the Income Tax Act. I have simplified the rules in a flowchart below.

To whom Form 15CA/CB needs to be filed?

You need to furnish these forms to the Authorised Dealer (AD) bank where you have an account and wish to remit the funds either to an overseas account or to your own NRE account.

Note that as per FEMA, RBI has delegated the compliance responsibility of overseas transaction to banks. Hence, in absence of these forms, the bank will not process the transaction.

The BIG issue: Bank has the final say which form to submit

Though the legal provisions in a flowchart above may seem very smooth, the situation on the ground can be very different. Though you go to the bank with one interpretation of the law, the bank may take an altogether different interpretation and require you to submit a form where the income tax rules do not require it.

For example, Mr. A, a resident Indian wants to transfer Rs. 10 lacs out of his accumulated savings in job to his son in Canada by way of gift. In this situation, Mr. A will argue that this amount is not chargeable to Income Tax Act, and falls within the USD 2,50,000 limit under the Liberalised Remittance Scheme, so this amount should be allowed to be transferred without any forms/compliances.

However, in this case, bank does not know whether this INR 10 lacs is accumulated savings from salary or sale proceeds of a property and hence will insist that it is covered under head “chargeable to Income tax act” and since payment > INR 5 lacs, he need to submit Part C of Form 15CA and also provide CA certificate in Part B.

Note here that bank is trying to protect itself in such a case, because later if it is found that INR 10 lacs was indeed something on which TDS was not deducted, and bank remitted funds, it can lands in a soup.

Now, Mr. A can endlessly fight with bank A or submit the Form 15CA and Form 15CB to bank to process the transaction.

Hence, when a client comes to me for certification, though I know which form is applicable for a particular transaction, I always advise him to contact his bank first on what forms they require, because they have the final authority to pass the transaction or not.

And it is my view that even if bank’s view is different from our view, there is no point wasting unnecessary time and just do the compliances so that the transaction does not get stuck.

How you can prepare and file Form 15 CA and Form 15CB?

Okay, so you have checked with your bank and CA on which exact form needs to be filed.

For Form 15CA, you will have to fill it on the e-filing portal of Income Tax Department www.incometaxindiaefiling.gov.in. Refer this guide by Income Tax Department – Instructions to file Form 15CA and Form 15CB

For Form 15CB, you will have to provide the Form 15CA copy along with documentary evidence of source of funds and tax payment receipt like property sale deed, TDS return copy, etc. CA will file Form 15CB electronically on the IT website using his digital signature. Now, you will have to submit the printout of Form 15CA and 15CB (as applicable) to the bank to process the remittance transaction.

Points to note on Form 15CA/CB procedures

- The obligation of deducting correct TDS u/s 195 of the Income Tax Act rests with the remitter only. In case proper TDS is not deducted and said funds are remitted, remitter cannot escape from the provisions of the Income Tax Act.

- There is no time limit specified for remittance of funds after filing Form 15CA and obtaining CA certificate in Form 15CB

- Form 15CA & Form 15CB once filed can be withdrawn within 7 days of filing. Form 15CB cannot be withdrawn once Form 15CA is filed.

- In case of certain payments for which TDS has been deducted at a beneficial rate under DTAA, remitter will ask for TRC and/or Form 10F of the remittee and he needs to provide the same in order to claim benefit of a reduced rate.

Form 15CA/CB requirement in case of property sale transaction by NRI

Majority of Form 15CA requests I get by NRIs who are settled outside India (even acquired foreign citizenship and are now an OCI) and have sold property in India and wish to remit the proceeds to their country of residence.

In this situation, there can be three situations:

- Buyer has deducted applicable TDS: OK, no issues. CA will check documents and issue certificate in Form 15CB. Remitter will prepare Form 15CA, attach printout of Form 15CA given by seller and provide it to the bank. Bank will wire the funds overseas or credit to the NRE account, as desired by remitter.

- Remitter NRI has obtained a NIL deduction certificate from Assessing Officer: In this situation, as per Rule 37BB of Income Tax Rules, CA certificate is NOT REQUIRED at all. Remitter will fill Part B of Form 15A on Income Tax website, take a print and submit to bank.

- Buyer failed to deduct applicable TDS: Here, there will be an issue. In such a case, CA will not issue Form 15CB to seller. In absence of a CA certificate, repatriation is not possible on those funds. This is one of the reasons I advise NRIs to compulsorily ask the buyer to deduct TDS at applicable rate, because they will have to present that proof to CA so that CA can issue Form 15CB otherwise funds remain non-repatriable.

Now let us come to some specific issues.

NRI has sold a property in August 2023. He has a time limit upto 2 years after sale to invest in new property and claim exemption u/s 54 of Income Tax Act- Buyer has relied on the declaration and not deducted TDS as seller promises to invest entire capital gain in purchase of new house.

In this case, how should a CA issue Form 15CB? Should he rely on the declaration by seller? In my view, NO. Remittee should either produce proof of deposit in CGDS/receipt of Section 54EC bonds only then Form 15CB should be issued

Form 15CA/CB requirement in case of NRO to NRE transfer

You may ask, both NRO and NRE are your own accounts, so why need for documentation. See, transfer to NRE account by all means qualifies as a remittance out of India. Once money is in NRE account, no bank will question it if you repatriate it out of India.

So, at the time you wish to transfer funds from your NRO to NRE account, the checks in form of Form 15CA/CB have been enforced so that bank is sure that funds being transferred are tax paid funds.

On a broader note too, given the fact that interest income from an NRO account is fully taxable and carries a TDS rate of 30%, in case the amount lying in the account is very high, it makes a lot of sense to transfer it to an NRE account.

Read more about tax implications of non-resident accounts here: NRO, NRE, FCNR, RFC: Tax and FEMA Implications for Returning NRI

As per FEMA (Remittance of Assets) Regulations 2016, you are allowed to transfer upto USD 1 MN per financial year from your NRO account to NRE account or for overseas repatriation.

Remember that while doing so, you also have to give an undertaking to the bank that these are your own legitimate funds and are not borrowed/transferred from other account. Read more in my post: Remittance facilities to NRI & Expats under FEMA

So, if you borrow funds say Rs. 10 lacs from your family member and try to repatriate it, it is not allowed. It will be construed as a FEMA violation. Even CA will ask you to explain source of funds of this INR 10 lacs.

Common Issues faced by clients in Form 15CA/CB issuance

Below are some of the examples of cases that I have come across during my certification work. Below are my generalised views but facts of the specific case need to be seen before coming to any conclusion:

- Does 5 lac limit apply per remittee or all remittees together – in my view, it should be all remittes taken together

- Refund of hotel booking in India – can you claim credit in NRE account? – Try convincing your bank – if amount is small, and payment is made from NRE, bank should allow you

- Refund of advance paid to builder? – It is a capital transaction. If payment done from NRE and sufficient documentation of the transaction is available, bank can allow without asking for forms

- Surrender of LIC policies – In this case, banks DO ask for the certificate especially after TDS has been introduced on non tax free policies.

- Should I do one transfer or multiple transfers – In my view, does not matter, do it all at once and it will be less hassle – if you do it separately, form 15CA/CB required for each transfer

- Gift by parents to child/close relative settled out of India – strictly speaking, Form 15CA CB compliance is not required in this case however banks can insist – parents can transfer upto LRS limit of USD 250000 per financial year – read more on LRS in this post: Guide to Liberalised Remittance Scheme (LRS) of RBI

- Expat working in India for a few months/years and then going back – will need Form 15CA/CB certification to remit the money overseas

- PPF redemption proceeds – banks should not insist on Form 15CA/CB compliance as the amount is not taxable however some banks can still insist, in which case there is no option to file the forms

- Funds received in NRE – Residential status changed – become resident – NRE account converted to resident – again become non resident – account reconverted to NRO – In this case, once the funds come to NRO, it is very difficult to convince the bank that these were repatriable funds – most likely, you will have to provide forms to the bank – and that is why a returning NRI should consider RFC/FCNR route – read more in this post: Financial strategy for NRI/PIOs returning for short duration to India

- If TDS has not been deducted by buyer on rental income, you will face difficulty to get a CA certificate & repatriate it out of India – so NRI MUST ensure that the tenant deducts TDS on rental income

- As per actual practice, banks require only the owner of NRO account to furnish the Form 15CA – they generally do not allow mandate holders to do so

- Purchase of property outside India – will Section 194IA be triggered? – In my view, yes, if purchased from a resident. See more on TDS for NRIs here – Guide on TDS implications for NRIs

- Sometimes it happens that even though you’ve made say mutual fund investments from NRE account, at the time of redemption bank requires you to credit in NRO account – this is not a correct practice as per FEMA – in such a case, you can check with another bank OR take the proceeds in NRO account & then repatriate it to the NRE account following Form 15CA/15CB procedures

Form 15CA & CB resources on Income Tax Department Website–

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com

Leave a Reply