In an earlier post, we have discussed about FATCA and CRS and why US NRI need not fear these new developments as long they are assessing their tax residency properly, offering full income in their tax returns and filing proper reports with the IRS.

Speaking of reports, there are two main reports that a US person needs to file to IRS, and those are Foreign Bank Account Report (FBAR) also known as FinCen Report 114 – (read an overview of FBAR in this post)and Form 8938 – Report on Specified Foreign Financial Assets.

In this post, I am explaining broad provisions and requirements of Form 8938 so that the US Residents are fully compliant on their IRS obligations in this matter.

Purpose

Form 8938 is mandated reporting by IRS to enable specified individuals to report specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. The objective of this report seems to be very clearly to identify such accounts and ensure that the US persons are offering the income from these accounts in their tax return.

Who needs to file Form 8938

A person has to fulfil following criteria to be covered under this requirement:

- A U.S. citizen; or,

- A resident alien of the United States for any part of the tax year; or,

- A non- resident alien who makes an election to be treated as a resident alien for purposes of filing a joint income tax return

AND

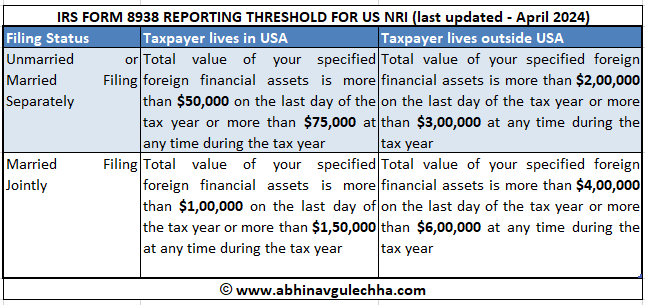

Such person has specified foreign financial assets exceeding the threshold as per below table:

Specified Foreign Financial Assets

Specified foreign financial assets include the following assets (I’ve inserted my notes/comments at appropriate places):

- Financial accounts maintained by a foreign financial institution (this will include all your bank accounts in India – Resident, NRO, NRE, FCNR, RFC, everything!)

- Stock or securities issued by someone that is not a U.S. person (including stock or securities issued by a person organized under the laws of a U.S. possession) – (if you have a resident or a PIS demat account in India, that account will come here)

- Any interest in a foreign entity (for example, if you have any interest in partnership firm, LLP, company etc. in India)

- Any financial instrument or contract that has an issuer or counterparty that is not a U.S. person (including a financial contract issued by, or with a counterparty that is, a person organized under the laws of a U.S. possession) – (this will include almost everything else: NSC, mutual funds, debentures, fixed deposits, etc)

- Interests in foreign pension plans and foreign deferred compensation plans (for example, National Pension Scheme or Employee Provident Fund in India)

- Interest as a granter/beneficiary in a foreign trust.

Exempt assets:

- Non-financial assets (e.g. land/flats owned in India or any commodities like art, gold etc.,)

- Social security, social insurance, or other similar program of a foreign government (now, does this mean that the EPF, PPF, NPS accounts are excluded? In my view, NO. Reason is: Since India does not offer any formal “social security”, these products cannot be termed as social security products in true sense)

- A financial account that is maintained by a U.S. payer (e.g. your USA MF holdings, USA brokerage accounts, IRA/401K accounts)

Some other points:

- A joint owner of an asset has an interest in the entire asset. In case of joint holding by spouses, each spouse can consider one half of the asset in his own computation, if filing is done separately.

- For reporting maximum value of the asset in Form 8938, first the determination has to be done in foreign currency and then converted to USD at a treasury specified rate (use this link to know the rates)

Where to file

This report has to be filed to the IRS along with your tax return. Do not file this report on a standalone basis to the IRS.

Filing timeline

This filing has to be made along with your tax return, so your tax return timelines will apply for this reporting too. Generally, it is April 15. You can claim an extension if you opt for an extension for your tax return. Note that there is no automatic 6-month extension that you get in FBAR.

Penalty for non-filing of Form 8938

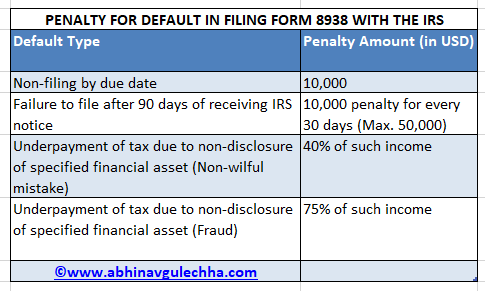

Penalty for non-filing is severe and given in the table below:

In additon to above, there is also a provision for criminal penalties for wilful non-filing or false filing.

What to do if you have missed earlier year filings?

Good news is that reasonable cause exception applies where you can file Form 8938 for earlier years and explain to IRS that failure is due to reasonable cause and not to wilful neglect on your part. For this purpose, you will have to amend your earlier tax return: update information in Schedule B as well as file information in Form 8938.

Other important points on Form 8938:

- Form 8938 reporting requirement is linked to your tax return. If you are not required to file a tax return, you don’t have to file FBAR even if the value of your specified foreign assets is above the reporting threshold.

- Double check to ensure that the information mentioned in the Form 8938 is matching on the tax return.

- Form 8938 reporting obligation is INDEPENDENT of FBAR. That means, even if you qualify for Form 8938 reporting, YOU STILL NEED TO FILE FBAR if you meet the threshold outlined for FBAR.

- For purposes of figuring the total value of specified foreign financial assets, the value of a specified foreign financial asset denominated in a foreign currency must be first determined in the foreign currency and then converted to U.S. dollars.

- If you dont file FBAR the IRS statue of limitation for income tax returns of 3 years/6 years get extended

References and Additional Reading: Form 8938 Guidance on the IRS website

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com