Some time back, I wrote a post on TDS rates for payment to NRI. In that post, I’ve discussed why in most of the times especially in property transactions, the NRI seller will face TDS @ 20.60%/ 30.90% (or 23.07%/ 35.535% in case property value > 1 CR) on the FULL SALE CONSIDERATION of the property.

Also read: NRI Tax Implication w.r.t. Immovable Property Transaction in India

In such cases, the NRI seller/remittee faces a big challenge: a big portion of his money gets locked till he files a tax return and gets a refund which can be anywhere between 1-2 years. Also, if refund is delayed, then there is additional pain in terms of following up with the Assessing Officer.

There is one solution to this problem.

And that is: Income Tax Act (ITA) allows such NRI to apply to his Assessing Officer (AO) for a lower TDS certificate. This certificate will allow buyer to deduct the TDS at such lower rate.

In this post, I will explain you the cost benefit of applying for this certificate and how to actually go about applying for this certificate to the AO.

Opportunity cost of not applying for lower TDS certificate

Let us understand with the help of an example.

A, an NRI, enters into agreement with B, a resident for sale of property in Mumbai for INR 2 crore in April 2016. A does not have any other income.

B deducts TDS @ 23.69% [(20% * 115%)* 103%] which comes to INR 47.38 lacs.

A invests entire capital gain in Section 54EC bonds by September 2016 and hence his taxable income for the financial year 2016-17 as per Income Tax Act is zero. He files a return in June 2017 and claims a refund of entire TDS of INR 47.38 lacs. He receives a refund of INR 47.38 lacs in March 2018.

In this case, A could have applied for lower deduction certificate to his Assessing Officer – let us assume he gets the certificate at 0.5% rate and suffers a TDS of only INR 1,00,000.

In this case, INR 46.38 lacs (INR 47.38 lacs – INR 1 lac) money of A has practically been locked with the Income Tax Department from May 2016 to March 2018 which is around 2 years without any interest!

Now, if this money was available and A had put it into an NRE FD which yields 7% tax free return, he would have earned INR 6.50 lacs.

So, the opportunity cost of not exploring this option is INR 6.5 lacs and this is not a small sum by any means.

Legal provisions on application of lower/nil tax deduction certificate

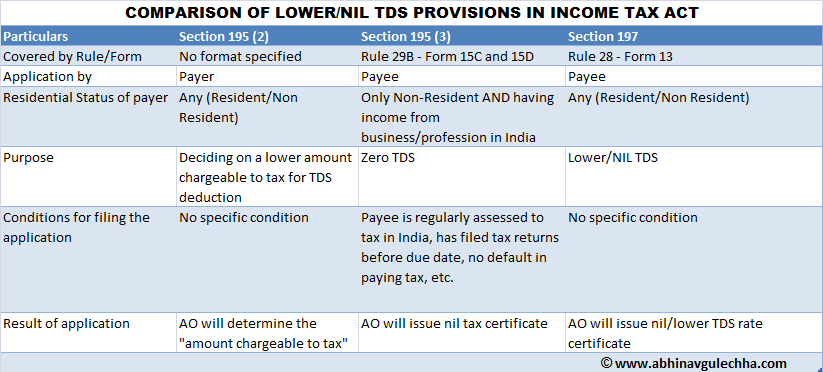

There are basically three sections in ITA which allow for claiming lower/NIL tax deduction certificate as follows:

- Section 195(2)

- Section 195 (3)

- Section 197

To make it easier to get a comparative overview of the legal provision, I have prepared a table please check:

Now, buyer of property making an application u/s 195 (2) will not be possible since as per ITA, buyer has to have a bona fide belief that income will not be taxable – no buyer can have that belief as he does not know the other incomes of NRI seller and should not even rely on the declaration.

Coming to application u/s 195 (3), it can only be made by NRI having business income in India – and it pertains to business related payments – so, this is also out of question.

So, the option for an NRI selling property and not having business income is to apply u/s 197.

Now, as per Section 197, NRI seller will have to apply in Form 13.

Go to this link on IT website: Link – A screenshot is given below:

As you can see, In Form No. on left hand side, type 13 and click “Search” – You will get 2 options here – either you can download PDF file, or you can download Fillable Form 13

I will recommend second option so that you can make all edits in the soft copy, send it to your NRI client out of India (if you’re a CA) and once it is approved, take a printout of the form.

Note that if you are opting for Fillable form, you also need to download the form opening utility – click on “Setup” down left on the same page

Form 13 Document Checklist

Form 13 requires a lot of details with respect to your present and past tax payments and return filings. Below is the checklist of documents you will need to file Form 13:

- Your PAN (Also read: Returning NRIs: Know how to apply online for PAN in India)

- Your TAN

- Your Passport (to ascertain residential status – also read: How NRI/PIOs can decode the Indian tax residency rules & save tax

- Sale Agreement/ Sale Deed (to ascertain the estimated amount of income & fill it in table given in Annexure IA)

- Income Tax Return for last 3 Years – if not filed due to income in India below exemption limit, you can sign a letter stating the same and attach it along with Form 13 (Also read: Why Returning NRIs should continue filing tax returns even if no taxable income)

- Assessment Order for last 3 Years

- Detail of tax payment for last 3 years

- Estimated Tax computation for current year (which includes capital gain/loss from sale of property and also includes any interest)

- Detail of any existing demand/tax liability that is due on you NOW and needs to be paid

- Detail of any return (income tax return/TDS return/TCS return) that is due at this point but not filed

- Details of TDS and advance tax deposited for the year

- Details of any advance tax/TDS/TCS already deducted for this year, till the point you’re filing the form

Note: If you are taking help of a CA, you can simply provide him the login credentials of your account on the IT e-filing website and he can extract most of the below to prepare the form for you and that can ease out a lot of things for you.

How NRI can file Form 13 in India

Form 13 has to be filed in hard copy directly to the concerned Assessing Officer and there is no option to file it online like Form 15CA/15CB.

Ideally, the CA filing the form on behalf of NRI should fill Form 13 and create a docket of supporting documents during NRI’s visit to India. NRI can go through the same and sign the Form and also advisable to initial all supporting documents. The Form 13 should mention no. of supporting documents attached with the application. CA can then go ahead and file the form with the concerned AO.

Alternatively, if NRI is abroad and is conducting property transaction with the help of a POA holder in India AND if the POA document expressly allows the named person to file a lower TDS certificate in Form 13, then the POA holder can also sign it on behalf of NRI in India.

In such situation, it is advised that CA should also attach a certified true copy of POA with the Form 13 before filing it to the concerned AO.

Time limit for getting certificate

There is no prescribed time limit under the ITA for an AO to issue this certificate; however there are court judgements that say that AO should issue it as expeditiously as possible.

However, in my experience, it can take anywhere between 1 week to a month for issue of certificate. Again, it depends from officer to officer and city to city.

Good thing for NRIs based in metros like Mumbai is that instead of applying to the local Assessing Officer, you can apply to the designated officers in the international tax office and get faster issuance of the certificate. For example, you can check this link for international tax office codes for Mumbai: Link

It is hence advisable to hire a professional CA for this work who regularly deals in these matters and can put your application in front of the right authority.

Other Important points on Form 13 filing

- Form 13 cannot be filed in advance. It should be filed after signing of the sale agreement between parties

- In case of property sale, you can cross Annexure 1 and Annexure II as not applicable. Only fill Annexure IA.

- Buyer must note that only a certificate from the Assessing Officer specifying a lower TDS rate can allow him to deduct TDS at a lower rate – buyer should not just rely on the copy of application filed by the payer – if he does so and deducts TDS at a lower rate, it is a violation of Income Tax Act and payer can be deemed as “assessee in default”

- Even after deducting TDS at reduced rate, buyer is liable to obtain TAN and file a zero TDS return.

- Form 13 is prospective only and cannot be applied retrospectively – Sri Santhalakshmi Mills (P.) Ltd. v. Income-tax Officer

- If you have received lower tax deduction certificate, and want to remit the funds from sale of property abroad or toyour NRE bank account, you need to just file part C of Form 15CA and do not need CA certificate in Form 15CB (Also read: Form 15CA/CB compliances by NRI: Procedure and Issues) – note also that in actual practice, I’ve seen banks still demanding a CA certificate in Form 15CB.

- If there are multiple sellers (joint owners in the property), each seller will have to make a separate application in Form 13 & provide certificate to buyer – buyer will accordingly deduct TDS and file return separately for each seller.

How NRI claiming lower TDS should structure a property transaction

- There should be a clear clause in the sale deed on TDS as to the liability of buyer to deduct TDS, what rate – who will apply for lower/NIL certificate, time period by which buyer will hold the TDS amount, etc.

- Both parties to sign the sale agreement.

- Buyer to release full payment except the amount equivalent to TDS at applicable rate on full agreement value

- Simultaneously, NRI seller can request CA to keep Form 13 ready. Once it is ready, NRI seller can review it, sign and request CA to file it to AO.

- Buyer to wait till 7th for receipt of TDS certificate of the month following the month he made the payment to seller was made. In the meanwhile, buyer must apply & obtain TAN (required to deposit TDS and file return)

- If NRI seller provides the certificate by 7th, buyer to go ahead and deposit TDS as per that rate to the government account. Buyer shall also refund difference between amount withheld and amount deposited to government, to the seller immediately. Buyer to file TDS return (file return even if no TDS deducted as per AO certificate) and provide copy of same to the seller (see example # 1 below)

- If NRI seller is not able to provide the certificate, buyer to deposit entire amount withheld. Buyer to also file TDS return and provide copy of same to the seller. (see example #2 below)

Some examples to understand better

#1: Seller gets lower TDS certificate

A, an NRI, enters into agreement with B, a resident for sale of property in Mumbai for INR 2 crore. A had purchased this property in 2007. Applicable rate for B to deduct TDS is 23.69% [(20% * 115%)* 103%]. B withholds TDS amount INR 47.38 lacs and makes a payment of INR 1.5262 CR to A

A files Form 13 and gets a certificate for TDS deduction at 0.1%. So, TDS applicable will be INR 20,000 and B will deposit this in Government account. B will also refund the difference TDS to A i.e. INR 47.18 lacs (INR 47.38 lacs – INR 20,000)

#2: Seller does not get a lower TDS certificate

A, an NRI, enters into agreement with B, a resident for sale of property in Mumbai for INR 80 lacs. A had purchased this property in 2014. Applicable rate for B to deduct TDS is 30.90% (30% * 103%). B withholds TDS amount INR 24.72 lacs and makes a payment of INR 55.28 lacs to A

A files Form 13 but does not get a lower rate certificate (presumably because it is a short term capital gain). So, B will deposit entire amount of INR 24.72 lacs in Government account. A will have to file a tax return and claim the refund of this TDS.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com