Last Updated Date – August 08, 2025

Employee Stock Option (ESOP) Employee Stock Purchase Plan (ESPP)/Restricted Stock Units (RSU)/Stock Appreciation Rights (SAR) have become one of the most common forms of executive compensation over the past decade. It started from Information technology sector and gradually spread to other sectors as well. While the 2009 change in Income Tax Act (ITA) has clarified a lot on this aspect, there are still lot of issues with respect to cross border ESOP transactions and particularly where DTAA comes into the picture.

In this post, I will be talking about the tax implications of ESOPs in India.

Before we proceed, a few points

- ESOP is the most common form of compensation option in India and the most complex in terms of taxation and I have tried to cover it in most detail here. The other compensation options like ESPP/RSU/SAR are more prevalent outside India and though I have tried to cover it here, it is not as comprehensive as ESOP.

- Legal position under Indian income tax law has changed substantially over the year and especially from FY 2009-10 – so, I will write these posts with a presumption that shares were allotted in pursuance to ESOP scheme to you in FY 2009-10 or after – if before, the tax implications may be different.

- This post is written only from Indian tax law perspective. So, if you are a tax resident of some other country then please check the tax implications in taht country as well.

- ESOP taxation is a highly interpretative subject given lack of clarity on many issues. Please consult a tax professional with your personal tax situation before taking a decision.

- If a person has ESOP/ESPP/RSU/SAR in his portfolio, when to exercise it, whether to subscribe to the plan or let it go by from a personal financial perspective is a very important matter– I will not discuss those in this post and take it up in a separate post – this post only concerns with the taxation aspect.

- I usually spend a good amount of time researching legal precedents on tax issues – hence, if you are a CA and plan to do so, please keep in mind that most of the judgments available on this issue date back to pre-2009 period where either Fringe Benefit Tax (FBT) was applicable or there was nothing expressly mentioned in the Act giving rise to each court to make its own interpretation– Finance Act, 2009 insertions in Section 17 overrules/invalidates most of these decisions so please keep that in mind. As regards ESPP/RSU/SAR, there are not much legal precedents available as compared to ESOP but whatever I have reviewed, I will try to cover here.

ESOP – Meaning & how it works

ESOP is basically an “option” given to the employee to purchase the shares and become a part owner of the company. It is a carefully designed scheme with an objective to align the interests of the employee with that of the company and with an assumption that the more aligned an employee feels with the company, the more harder (smarter) he will work and this will ultimately reflect in the share price of the company over time.

Apart from alignment of interests, it also works as a retention tool used by employers to retain employee – and this is precisely why employers phase out the vesting of options over a number of years so that the employee stays with the company in the hope that he will be able to cash out the options profitably – this is even more so when the employer inflates the CTC artificially by the ESOP component – employee feels that if he resigns, he will lose something that was rightfully his and acts as a golden handcuff for the employee [sidenote – If an employment starts impacting your mental health, its time to let go and not remain bound by the golden handcuff in form of ESOP/RSUs]

Good thing about ESOP is that there is no upfront commitment by employee – only when options are exercised, he may be called upon to pay a nominal price or even nothing. Also, it is an “option” to purchase and there is no compulsion – if the market price of the stock as on the date of exercise is less than exercise price, in all probability, employee will not exercise the option and let it pass so that way the discretion is with the employee.

Life Cycle of an ESOP

There are basically four stages of ESOP as follows:

- Grant: This is the first stage where employer grants you the option to purchase equity shares in future. In India, employer has to frame the ESOP scheme in line with SEBI ESOP guidelines and FEMA regulations. This grant may be one time grant or spread over many years, depending on the ESOP scheme. At this stage, employee acquires a right in the form of option but he cannot do anything with it.

- Vesting: In this stage, the options “vest” with the employee and he acquires the power to “exercise” the option and buy shares. Generally, ESOP schemes do not allow a person to transfer the options to any other person or claim any compensation by surrendering the option.

- Exercise: This is the event where person actually exercises the option and by way of this, gets an allotment of shares. Generally, employers give “cashless options” which mean that in case employee had to pay anything for the share from his pocket, it is adjusted at the time of exercise and that much lesser number of shares are issued. Within a few days or months of exercise, the shares are allotted and credited to the employee’s demat account. Now, employee is absolutely free to hold or sell the shares as deemed fit.

- Sale: At this stage, employee goes ahead and sells the shares and receives the credit of the amount basis the prevalent market price of the share, in his bank account.

Taxation of ESOP in India

Now let us come to taxation of ESOP in India. In India, taxation of ESOP is in two stages as follows:

Stage # 1: At the time of allotment of share by employer (note that there is a time lag between exercise and allotment) as “Income from Salaries”

Stage # 2: At the time of sale of share by recipient as “Income from Capital Gains”

I am describing both taxation stages in detail below:

Stage # 1: Under “Income from Salaries”

Concerned extract of Section 17 of Income Tax Act (ITA) is given below:

“………

(vi) the value of any specified security or sweat equity shares allotted or transferred, directly or indirectly, by the employer, or former employer, free of cost or at concessional rate to the assessee.

Explanation.—For the purposes of this sub-clause,—

(a) “specified security” means the securities as defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) and, where employees’ stock option has been granted under any plan or scheme therefor, includes the securities offered under such plan or scheme;

(b) “sweat equity shares” means equity shares issued by a company to its employees or directors at a discount or for consideration other than cash for providing know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called;

(c) the value of any specified security or sweat equity shares shall be the fair market value of the specified security or sweat equity shares, as the case may be, on the date on which the option is exercised by the assessee as reduced by the amount actually paid by, or recovered from, the assessee in respect of such security or shares;

(d) “fair market value” means the value determined in accordance with the method as may be prescribed;

(e) “option” means a right but not an obligation granted to an employee to apply for the specified security or sweat equity shares at a predetermined price;

…………” (emphasis supplied)

Important points from reading of above are as follows:

When employer grants the option to you or options vest in you or you exercise the option, there is NO tax liability on you. It is only when shares are “allotted” to you does tax liability arises on you. Imagine a case where employee exercises the option on March 28, 2023 and shares are actually allotted on April 5, 2024 – here, in what year will the taxability arise? It will arise in FY 2024-25 and not FY 2023-24.

Now, as per Section 17, what will be taxable is the FMV as on date of exercise of shares less any price paid by employee for purchasing the share.

Also please note that the perquisite will be taxable even if ESOPs exercised pertain to your former employer. However, there is a favourable ITAT judgement in case of Assistant Commissioner of Income-tax, Circle -48(1) v. Robert Arthur Keltz [2013] 35 taxmann.com 424 (Delhi – Trib.) wherein it has been held that only that perquisite is taxable only to that extent to which service was rendered in India.

Having said this, the issue is not free from litigation till CBDT provides any formal guidance.

Special Provisions Relating to Deferred TDS by Employers of Eligible Startups

Income Tax Act contains a provision in Section 192(IC) which says –

- If the employer is an eligible startup under Section 80-IAC

- The perquisite by way of allotment of share is given in FY 2020-21 on afterwards

In such a case, TDS will be deducted within 14 days –

- after the expiry of forty-eight months from the end of the relevant assessment year; or

- from the date of the sale of such specified security or sweat equity share by the assessee; or

- from the date of the assessee ceasing to be the employee of the person,

whichever is the earliest, on the basis of rates in force for the financial year in which the said specified security or sweat equity share is allotted or transferred.

So basically, an employee who has been allotted shares on April 1, 2023, tax on perquisite value (FMV of the share) shall be deferred till April 14, 2028. This is beneficial provision and will help many ESOP holders so that they are not taxed n allotment of share without any corresponding inflow/income in that year.

However, the provision is restricted to only employees of eligible start-ups as of now. If you’ve received ESOPs from an Indian start-up, you can ask your Finance team whether it qualifies as an eligible start-up for you to get the tax deferral benefit.

Stage # 2: Taxation of capital gains on sale of shares

Once shares are issued to you, then the employer angle is wiped out. Then, the taxability of income rests on what is your tax residential status, where the share is located/listed and whether money is directly received in India. Here, there can be two situations – share is located/listed in India or outside India.

- Share is located/listed in India

If the share is listed on an Indian stock exchange or pertains to an Indian company, capital gain is taxable to you in India irrespective of residential status or where you’ve rendered services etc. Holding period for classification of capital gain as short/long term for such share shall be 12 months. In such case, the taxability shall be as follows:

- Short term capital gain: 20% + SC + HEC

- Long term capital gain: 12.5% + SC + HEC (on capital gain in excess of INR 1.25 lac per financial year)

In case amount is taxable and person is non-resident, TDS @ 31.2% will be deducted by the broker u/s 195 of ITA before remitting the amount – person can claim this TDS by filing a tax return in India. Read more here: NRI Tax Return Filing Mistakes & How to Avoid Them

- Share is not listed in India

If the share is listed on any non-Indian stock exchange (like NYSE, NASDAQ or FTSE) or it is an Indian company which is unlisted, capital gain is taxable to you in India only if a) you are an ROR and /or money is received in India and/or c) services w.r.t. these shares were rendered during your stay in India.

Holding period for the purpose of classification of such capital gains as short/long term shall be 24 months. Hence, sale of such shares shall be counted as long term after holding for 24 months. As regards how such shares will be valued (if not listed), it is specifically provided in Rule 3 of Income Tax Rules. For the sake of brevity, I will not be talking about it here.

In such case, the taxability shall be as follows:

- Short term capital gain: Include in income for the year and taxable as per slab rates (note: facility of set-off up to qualifying exemption limit u/s 111A available only for resident)

- Long term capital gain (share of a closely held company): 12.5% + SC + HEC

In such cases, the broker may withhold tax as per tax laws prevelent in that country – for example, a broker in US may deduct 24% withholding tax on the payment unless a SSN/ITIN/W8BEN is available on file.

Hence, in case you do not wish foreign country broker to withhold tax or wish withholding to be done at a lower rate by claiming a beneficial clause in the respective DTAA, you need to submit relevant documentation prior to exercise [ example – W8BEN in case of US].

Special tax considerations in cross-border ESOP situations – Domestic tax law perspective

In my professional work, I come across several permutation/combination cases for e.g. returning NRI receiving ESOP/SAR from his USA employer, NRI based in USA but exercising ESOP issued by Infosys India, and so on. At the point of allotment/sale of share, the taxability will also depend on your residential status and the place of rendering services in India.

It is here that ESOP taxation gets slightly complex.

- There is no standard solution or a quick fix. Each case has to be evaluated in detail and appropriate provisions of not only ITA but DTAA also need to be seen, to come at a conclusion and to minimize tax liability. However, some general principles basis my interpretation of tax law in such cases is as follows:

- If ESOP pertains to a period of service rendered in India, the same will be taxable in India by virtue of Section 9 of ITA irrespective of who pays it, where it is received and what is the residential status of recipient.

- If in the year of ESOP allotment and/or share sale, you qualify as ROR, the income is taxable in India. Of course, DTAA relief etc. is possible, I will come to that.

- If ESOP has been issued by Indian company, it is taxable irrespective of your residential status as any income paid by Indian company “accrues” in India u/s 9 of ITA. This is my personal interpretation – a contrary stand can also be taken that Section 9 mandates deemed accrual of income if services are rendered in India – point I’m trying to make is, there is ample scope for tax litigation here.

- ESOP issued by foreign employer w.r.t. services rendered in India: taxable irrespective of your residential status as income is “deemed to accrue or arise” in India u/s 9 of ITA.

- Imagine a case of company resident of USA and having an employee working remotely from India who is a resident of India. In such a case, if company issues certain shares to employee as per its ESOP scheme, the perquisite shall be taxable to such employee in India. Company will be under an obligation under Income Tax Act to deduct TDS, obtain PAN and TAN in India and deposit TDS in government account. If not, company can be deemed to be “assessee in default” under Income Tax Act.

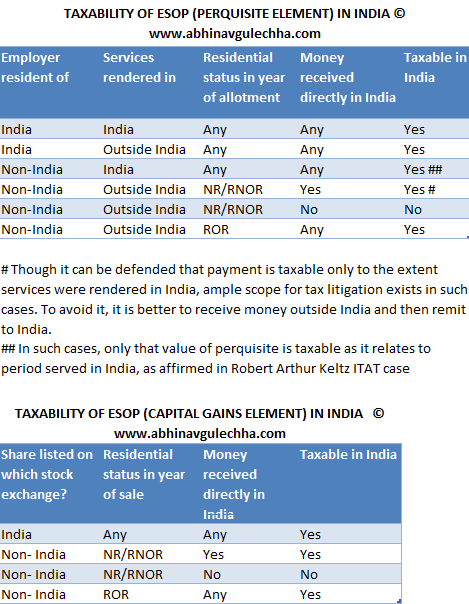

I am summarizing the above in a table below, which I hope can prove useful:

How to avoid double taxation in case of Cross border ESOP transaction

If any tax is withheld in foreign country, you can claim credit in India or explore provisions of DTAA between India and that foreign country. However, the biggest issue in claiming DTAA relief (and why it becomes all the more complicated) is that there are no clear rules defining the period of service that qualifies for ESOP income in each country.

It is here that we have the OECD commentary that is given due weight by Indian courts in interpreting the DTAA provisions Para 12 of the Commentary on Article 15 (on Dependant Personal Services) provide some guidance on this issue. Below, I am trying to mention the main pointers from that commentary below:

- The nature of perquisite element of the gain will be treated under Article applicable to “Dependant personal services” even if options exercised pertain to former employer. In case of sale of shares, the income will be in nature of Capital Gain and dealt with under Article 13

- Generally, country of source as well as residence of taxpayer both retain right to tax the income. In such case, source state will retain the right to tax the income even if employee is no longer employed by same employer.

- Article of DTAA does not in any way impose on the right and manner of taxation of source country on that income.

- Determination of whether and to what extent ESOP is derived from employment exercised in a particular country has to be calculated on the basis of facts and circumstances including the contractual conditions associated with the option.

- ESOP should not be considered to related to services rendered after the period of employment that is required as a condition for employee to acquire right to exercise the option. Hence, for example, an ESOP agreement grants certain options with a condition that they become exercisable only after continuous service of 3 years, the period reckoned for counting service period in source country should not exceed 3 years.

- it is important to distinguish between a period of employment that is required to obtain the right to exercise an employee stock-option and a period of time that is merely a delay before such option may be exercised (a blocking period).

- It is also important to distinguish between a situation where a period of employment is required as a condition for the acquisition of the right to exercise an option, i.e. the vesting of the option, and a situation where an option that has already vested may be forfeited if it is not exercised before employment is terminated (or within a short period after). In the latter situation, the benefit of the option should not be considered to relate to services rendered after vesting since the employee has already obtained the benefit and could in fact realise it at any time.

- Where a stock-option is considered to be derived from employment exercised in more than one State, it will be necessary to determine which part of the stock-option benefit is derived from employment exercised in each State for purposes of the application of the Article and of Articles 23 A and 23 B. In such a case, the employment benefit attributable to the stock option should be considered to be derived from a particular country in proportion of the number of days during which employment has been exercised in that country to the total number of days during which the employment services from which the stock option is derived has been exercised.

Employee Stock Purchase Plan (ESPP): Meaning and taxation in India

Meaning: In case of an ESPP, the employer will offer you a scheme where you can purchase shares of the company at a discount from the prevailing market price which generally is in the range of 2-15%. Here, there are select windows like twice a year where you can purchase the shares at discount. There is a certain lock in period before you can go ahead and sell the shares. Thus, once you purchase the share, the risk on that investment going down in value shifts to you.

Taxation: In ESPP also, there are two stages of taxation like an ESOP as follows:

- At the time of allotment of share: The “discount” (difference between FMV on the date of exercise of the ESPP vis a vis the price paid) will be treated as “perquisite” and charged to tax as “Income from Salaries”

- At the time of sale of shares: Like normal capital gain as explained above.

Restricted Stock Units (RSU): Meaning and taxation in India

Meaning: In case of RSU, your employer will offer you say 500 RSUs at the time of your joining and make it a part of your compensation package but the catch is that you cannot just go ahead and sell it – there is a certain vesting schedule (or you can say lock-in period) – you can sell them ONLY after vesting schedule is over.

Taxation: In RSU also, there are two stages of taxation like an ESOP as follows:

- At the time of allotment of share: The FMV of the share on the date you opt for RSU will be treated as “perquisite” and charged to tax as “Income from Salaries” in the year the share is actually allotted to you

- At the time of sale of shares: Like normal capital gain as explained above.

Stock Appreciation Rights (SAR): Meaning and taxation in India

Meaning: This compensation mechanism is very different from ESOP/ESPP/RSU because in this case, there is no “allotment of shares” to the employee. What happens is that the company gives you the “right” to cash in on the appreciation in the value of shares between the grant date and exercise date. There is a definite time after grant date where you’re not allowed to exercise the right which is primarily to retain you with the company and align your interests with that of the company. Cost of share on grant and exercise date for a listed share generally is the market value on the recognized stock exchange. For an unlisted share, it can be any other agreed value as per SAR policy terms and conditions. On the exercise date, if the exercise value is lesser than that as on grant date, the SAR has practically no value and employee will not exercise it. If it does, then employee will exercise it and such appreciation will be considered as income in hands of employee.

Taxation: Since the compensation mechanism is very different in case of SAR, the taxation of SAR is single stage taxation (as against two stage taxation in ESOP/ESPP/RSU cases) – here, the incidence of tax arises at the time of exercise of your right in the SAR. The amount received on exercise of the right is taxable as “Income from Salaries”

Other points on ESOP/ESPP/RSU/SAR taxation:

- If you are liable to be taxed on ESOP/ESPP/RSU/SAR perquisite in year of allotment of shares in India, your employer is bound to deduct TDS u/s 192 of the Act and issue you a Form 16 – you can claim the TDS in your tax return for the year.

- As regards surcharge, there is no surcharge till INR 50 lacs, for payment between INR 50 lacs – 1 CR, 10% and for > INR 1 CR – 15% SC is applicable. Calculation and payment of advance and self-assessment tax has to be done accordingly.

- In case employer does not deduct TDS, it is non-compliance at the end of employer and not you. There is a favourable judgment in case of Sumit Bhattacharya v. Assistant Commissioner of Income-tax*, Circle 16(1), Mumbai [2008] 112 ITD 1 (Mumbai) (SB) whereit has been held that in such case where non-compliance w.r.t. deduction of TDS was of employer, Assessing Officer (AO) cannot charge interest u/s 234B of ITA on the employee.

- In case you are a ROR and your exercise of ESOP or sale of shares results in foreign income, you must disclose that foreign income and foreign assets in Schedule FSI and FA respectively – this is required under Black Money Act – also read: How NRI should disclose their foreign income/ assets in Indian tax return

- No penalty can arise if assessee had a different interpretation of law, full disclosure was made and there was no intent to evade tax –Commissioner of Income-tax, Delhi-XV v. Smt. Neenu Dutta [2013] 35 taxmann.com 454 (Delhi)

- Even if there is no employer-employee relationship and the ESOP scheme is also extended to independent consultants, the perquisite related tax implications can arise – Assistant Commissioner of Income-tax, Circle 14(1) vs. Chittaranjan A. Dasannacharya [2014] 45 taxmann.com 338 (Bangalore – Trib.)

- Even if the ESOP/ESPP/RSU/SAR has been given by parent/holding company of employer, still the perquisite component is taxable as “Income from Salaries” in India – Soundarrajan Parthasarathy v. Deputy Commissioner of Income-tax, Chennai as reported in [2016] 70 taxmann.com 27 – I have analysed this judgment here in detail: Taxability of Stock Appreciation Rights (SAR) in India

- In case of cross border ESOP (especially where only a part of the total ESOP perquisite is offered to tax in India), you must preserve copies of appointment/deputation letter, work commencement certificate, passport entries or some other evidence to prove your work location.

- If you are a person resident in India as per FEMA (read: NRI Definition: FEMA Act VS Income Tax Act) and get shares by your foreign employer in lieu of ESOP AND you sell the shares, FEM (Realisation, Repatriation and Surrender of Foreign Exchange) Regulations, 2015 require you NOT to hold/use/reinvest the money outside India but to bring it to India within 180 days. You’re allowed under FEMA OI rules to not sell and hold the shares outside India indefinitely, but the moment you sell, the liability to repatriate to India arises.

- If the ESOP transaction has happened or is going to happen in India (for e.g. ESOP is paid by an Indian company or amount of a foreign ESOP has been received in India), you have the option to seek an Advance Ruling to seek a clarification on the taxability of those payments in India. In such a case, the ITD will be bound by the decision of Authority of Advance Ruling (AAR) in your case.

Issues in ESOP/ESPP/RSU/SAR taxation

- A subject of much debate and litigation has been cashless ESOPs – where the employee does not have to pay anything at the time of exercise, and in case of exercise, shares are sold same day and employer deducts his per share payment from the sale price – in such cases, courts have agreed to assessee contention that that what is being sold is the right in ESOP and since it is a long term asset, it should be taxed as long term gain – in my view, those decisions are nullified in view of insertion by Finance Act, 2009 – now, perquisite is chargeable to tax as routine, and if shares are sold same day, it will be taxed as short term capital gain at applicable rate.

- Should fee paid to trust/broker managing ESOP in say USA be deducted as “expenses on transfer” is disputed and there are judicial precedents on both sides. In my view, the fee does qualify for a deduction. However, fee for seeking tax/ legal/ investment advice should not be claimable and, on a conservative side, it should not be claimed as deduction.

ESOP/ESPP/RSU/SAR Tax planning tips for returning NRIs/globally mobile executives

- As far as possible, DO NOT “exercise” your options during your stay in India especially in the year you may qualify as a resident and ordinarily resident

- If your shares are listed in say USA, DO NOT advise your broker to credit the sale proceeds directly to a bank account in India. It is better to take the sale proceeds in an outside India bank account and then remit it to India.

- If the shares are of a US co., file Form W8BEN to the US broker so that no tax is withheld on the sale proceeds of shares in US.

- In case of long-term capital gain, you can claim exemption by investing in specified bonds in India (Section 54EC) or investing in a residential property in India (Section 54F).

- To avoid concentration risk, you may sell after exercise as soon as possible to avoid capital gain build-up and the sale proceeds you will have to bring to India and then you can invest in India/remit overseas [as part of LRS] in a diversified index ETF.

- If you are a returning NRI, wish to settle permanently in India and wanting to retain the shares issued outside India and the shares are at a MTM gain, you can explore sell and repurchase shares just before end of your RNOR period so as to re-adjust the cost of acquisition for future India capital gains tax computation purpose – however, while doing that, also be mindful of tax implications outside India.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this post can be reproduced without prior written permission of CA Abhinav Gulechha. The content of the post is for general information purposes only & does not constitute professional advice. For any feedback on this article, please write to contact@abhinavgulechha.com. For any India-US Crossborder Tax questions, please feel free to post on https://www.reddit.com/r/IndiaUSTax/