Recently I was working on a tax opinion for a returnee doctor formerly employed in NHS UK. (Also read: Returning NRI Financial Checklist)

During review of my client’s investments, I came across something known as an “Individual Savings Account (ISA)” in UK. Being tax free in UK, he did not bother to offer the income to tax in India. I researched further on the product and associated domestic tax law implications & India UK DTAA to find out whether income from that product is liable to tax in India.

In this post, I will be sharing insights on Taxation of UK Individual Savings Accounts (ISA) in India as well as other issues/compliances that such expats should keep in mind on return to India.

Before we proceed:

Please bear in mind that the information in this post is not tax advice and I do not practice UK tax law. If you have ISA investment, please consult a qualified CA in India and CPA in UK with your specific tax situation.

Major features of ISA

Some of the main features/points on ISA as an investment product are as follows:

- ISA are mainly 4 types – cash ISA, share/stock ISA, innovative ISA or lifetime ISA

- Person can open account from 18 years & above. In case of Lifetime ISA, you should be under age 40.

- This scheme is only for residents of UK. In short, a resident of India cannot open an ISA account in UK

- When you leave UK and are no more a UK resident, you cannot contribute further to the scheme however you can continue the scheme

- There is a maximum yearly allowance of £ 20000 (for UK FY 2024-25) that one can contribute to ISA in a tax year. FYI, tax year in UK is from April 6 – April 5

- There is NO maturity period in ISA (like we have 15 years in case of PPF in India) – you can continue as long as you wish, till your death. Account is closed on death.

- There is no tax on income & withdrawals from ISA. In short, it is completely tax free.

- There is no requirement to disclose income from ISA in UK tax return.

- One can withdraw money from ISA at any time, without losing tax benefits

- In case of death, there is no income tax or capital gains tax on ISA. However, ISA forms part of a person’s estate and is hence subject to inheritance tax in UK.

Taxation of ISA under Indian Income Tax Act

Income from ISA qualifies as “foreign income” under the Indian Income Tax Act (ITA). The broad rules for taxation of foreign investment income depend on a person’s residential status for that particular financial year in India as follows:

- Non Resident (NR) or Resident and NOT Ordinarily Resident (RNOR): Not taxable in India

- Resident and Ordinarily Resident (ROR): Worldwide income is taxable in India, subject to DTAA relief.

It is pertinent to mention here that even for NR/RNOR, though NR/RNOR is not taxed on income accrued outside India, however income “received” in India is taxable in India irrespective of a person’s residential status. Hence, I advise such clients to keep a UK bank account live even after your return to India so that when you withdraw funds from ISA, you collect it in the UK bank account first and THEN remit it to India.

The broad taxation rules on the income will depend on the type of income as follows:

Interest and Dividend: Taxable as “Income from Other Sources” as per applicable slab rates

Capital Gains: Taxable as “Income from Capital Gains” on special rates depending upon type of capital gain (short term/long term) – holding period for capital gain classification will again depend on type of asset within the ISA: if it is shares, it qualifies as unlisted shares as per Indian Income Tax Act & the holding period is 24 months and in other cases, it is 36 months – short term capital gain (STCG) is taxable as per applicable slab rates and long term capital gain (LTCG) is taxed at a special rate of 20% + SC + EC (generally, 20.80%) with indexation benefit.

Taxation of ISA under India UK DTAA

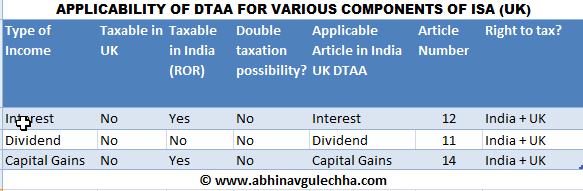

ISA is tax-free in UK and is taxable in India, once person is a ROR. So, ideally there is no double taxation as such on that investment. However, the DTAA provisions sometimes provide exemption from taxation in country of residence of the person from the tax and that is why I checked the applicable provisions of DTAA as per following table:

So, as we can see, both India and UK retain the right to tax ISA. A finer reading of the clauses suggests that UK will charge tax up to a defined maximum rate in such cases (mostly 15%). Apart from this, to my understanding, there is no specific mention of any provision which says that ISA type investments will be tax exempt in India.

Settled principle of tax law in India is that the taxpayer has the power to choose the law that is beneficial to him – in case, the domestic tax law provisions are beneficial (in the sense that no respite is offered in DTAA). So, India UK DTAA provisions in my view do not have a utility in terms of eliminating/reducing ISA taxation in India.

How recently returned NRIs can reduce tax liability on their ISA investments in India

A couple of strategies I would suggest here:

Strategy #1: Reset the “cost of acquisition” within the ISA

Cost of acquisition of each stock/ investment within ISA is the cost of acquisition as per its acquisition date and irrespective of your residential status. So, it is not like that only that only that capital gain component will be taxable from the date that you became an ROR.

Let us understand this with help of an example. You became an ROR in FY 2013-14 and you liquidate your ISA in FY 2016-17 – the stocks in question are held since FY 2011-12 – in this case, the entire accretion between FY 2011-12 (from date of acquisition) to FY 2016-17 (up to the date of sale) will be liable to capital gains tax in FY 2016 – 17 – it will be wrong logic to say that only accretion from FY 2013-14 (year when you became ROR in India) will be taxable.

And it is here that a very sound and legal tax planning strategy to minimise tax implication in India is to sell all holdings just before the RNOR period ends (before March 31 of the last RNOR year) and then re-purchase all holdings. This can be in exactly the same ratio or in a different ratio, from your asset allocation perspective or as suggested by your investment adviser.

What this will do is that it will help reset the “cost of acquisition” for capital gains computation purpose in India. So, when you later liquidate ISA completely, the cost of acquisition for capital gain purpose will be this higher COA and thus the capital gain will be lesser to that extent. If this transaction is done during RNOR period, there will not be any tax incidence in India.

However, before employing this strategy, please keep in mind following points:

- This strategy will work only case of mark to market gain – in case of a MTM loss, it can actually backfire and can actually increase your capital gains tax liability in India.

- This strategy applies to only those cases where the ISA comprises of stocks, mutual fund units or other assets that qualify as a “capital asset” under ITA. If it is a cash ISA, the income is interest income and is subject to different computation rules than capital gains.

- After doing this reset, you will have to wait for at least 24/36 months (depending on the nature of asset) from this reset date so that the gain on sale qualifies for long term capital gain and accordingly qualifies for a reduced 20% tax rate (as explained above)

- Sale and re-purchase within ISA does not give rise to any UK tax implication however it will attract India tax implication once you become ROR.

Strategy #2: Liquidate ISA only when capital gain qualifies as long term

If you missed liquidating your ISA investment during your RNOR period on return to India and are now an ROR and in the 30% tax bracket, before going ahead to liquidate your ISA completely, check the period of holding of individual assets within ISA and try to ensure that they cross the minimum 24/36 month holding period (as applicable) – this will ensure that the capital gain liability in India will be at a reduced 20% rate. This can save you tax depending how big your ISA corpus is. If you have trouble identifying the individual asset specific holding periods, take help of a CA.

India Black Money Law Implications of holding ISA in UK

In 2015, India enacted Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act (known as Black Money Act). This law is effective July 1, 2015 and requires a person who is a resident and ordinarily resident (ROR) under the ITA to disclose foreign income and assets in his tax return in India.

Also Read: Black Money Act: An Analysis

Also, corresponding changes have been made in Section 139 of ITA making any person having ROR status in India and holding foreign assets/beneficial interest to mandatorily file a return of income in India irrespective of the income in that financial year. A separate schedule named Schedule FSI and FA are given in the tax return where these income/asset disclosures need to be made.

Also Read: Guide to help Returning NRI/PIOs declare their foreign income/assets in Indian tax returns

An ISA forms part of the definition of foreign asset and income from ISA qualifies as foreign income.

So, if you are an ROR, and not earning an income above INR 3 lacs (basic exemption limit as of 2024), you are still required to file a tax return if you hold an ISA outside India. This is especially relevant to people who were working in UK and contributing to ISA, and after returning to India and becoming an ROR, are not working and thus do not have a taxable income in India. In short, the disclosure requirement for ISA as per the Indian Black Money Law will be as follows:

- NR or RNOR: No disclosure required unless income is directly received in India

- ROR: Yes, disclosure is required in all cases

What if you have failed to file returns/disclose your ISA in filed tax return

If you have failed to make a disclosure of ISA in your tax return after becoming ROR, severe penal implications can follow in terms of tax, penalty and prosecution under Black Money Act. I will advise you to not to dilly-dally and seek proper professional opinion. Some pointers here are as follows:

- If you’ve not filed a tax return for a year, you have time to file a belated return till December 31 of the relevant assessment year.

- If timeline for belated return is missed, you have the option to file an updated return under Section 139 (8A) however you will have to pay additional tax, penalty & interest on that income.

FEMA regulations on ISA investments of returning UK NRIs

As per FEMA regulations, a person returning to India and becoming a resident can maintain accounts and investments from his earnings outside India. So, post your return to India and becoming a resident of India as per FEMA (also read: NRI Definition: FEMA Act VS Income Tax Act you can keep the account and there is no need to close the account.

However, if you close the account, FEMA (Realisation, Repatriation and Surrender of Foreign Exchange) Regulations, 2015 require you to remit the amount to India within a reasonable time and cannot retain outside India – in such a case, if you wish to keep money in £ or $, you can open a Resident Foreign Currency (RFC) account in India and keep in that account. Money in RFC account can be freely repatriated outside India without any restrictions. To know about tax treatment of RFC accounts, you can read my detailed post here: NRO, NRE, FCNR, RFC: Tax and FEMA Implications for Returning NRI

Should you continue your ISA after your return to India?

This question has no straight yes/no answer. I am giving below some pros and cons below:

Option # 1: Retain

Pros:

- You will have a geographical diversification in your investment portfolio.

- If you have GBP denominated financial goals (e.g. sending kid to college in UK) or plan to retire back in UK, you save yourself from currency risk in the portfolio.

- If you return back to UK later, you can start your investments in your ISA account up to the mandated annual limit without any fresh formalities of opening an account.

Cons:

- The investment will no longer be a tax free investment for you. Dividend/Interest/Capital Gains income will be taxable in India as per your slab rate/special rates as discussed above.

- If you have returned to India for permanent settlement and have no financial goals in non-INR currency, if your ISA amount is significant , it will create a currency risk in your investment portfolio – read more about it here: How NRIs can manage currency risk in their investment portfolio

- On death, ISA will form part of your estate and may be subject to inheritance tax in UK if your total estate is valued > £ 3,25,000. There is a spousal exemption & higher limits for property transfer to children.

- You need to file complicated foreign income tax returns every year – any miss and severe penal implications in India may follow. CA will charge a higher fee for filing foreign income returns every year in view of the complexity and calculations involved.

Option # 2: Withdraw

Pros:

- You will lose geographical diversification in your investment portfolio to that extent – however, you can still invest in UK markets through dedicated feeder funds from India depending on your requirement.

- You settle the tax issues once and for all – no more foreign income returns and associated complexity, no more risk of litigation with tax office etc.

- You get freedom to invest that corpus (especially if it is a big amount) in India in alignment with your financial goals, especially if you do not intend to go back to UK.

- Withdrawal within RNOR period will not cause any tax liability in India

Cons:

- If you return back to UK, you will have to open a fresh account. Note that lifetime ISA can be opened only up to 40 years of age.

- If you do not have a proper plan of investing that money in India, it will either lie in a bank account or you can end up spending it

In my view, if the amount is insignificant and/or you don’t plan to return back to UK, it is better to close the account. However, if you do plan to return to UK or have long term goals in GBP, you can continue but, in that case, do not miss out on the tax compliances in India; else the penal implications can be very severe. If you’re planning to retain the ISA after moving to India ensure that the ISA provider supports non-UK residents & do proper nominations & will etc. in UK so that your beneficiaries can easily get the money in case of your death. Also you need to consider the equity & debt portion of your ISA investment for portfolio level asset-allocation calculation.

Copyright © CA Abhinav Gulechha. All Rights Reserved. No part of this article can be reproduced without prior written permission of the CA Abhinav Gulechha. The content of the article is for general information purposes only & does not constitute professional advice. For any feedback, please write to contact@abhinavgulechha.com