A returning NRI who’s worked for a long time in UK may have a significant chunk of his UK savings locked in a pension which cannot be withdrawn till 55. For such NRI, a question is whether to retain the pension in UK or transfer it to a QROPS in India or other advertised overseas jurisdictions like Malta, Isle of Man etc.

Before we proceed:

- Kindly note that this post is for general information ONLY and must not be construed as any investment/ pensions advice. Please consult with a financial adviser registered with the Financial Conduct Authority (FCA) UK with specific facts to get a detailed opinion.

- I’ve written a separate post on tax implications on UK pension in India, please read it here: Taxation of UK pension in India

Reasons when UK returnees consider moving pensions to a QROPS

First things first, it is important to understand that it is not compulsory for a UK returnee to transfer his pension to an overseas QROPS. It is perfectly OK for you to retain your pension in UK. In many cases, it may be even advisable not to tinker with your pension and let it remain where it is, especially if you may want to come back to UK later in your life.

However, below are a few reasons returnees from UK prefer moving pension to QROPS:

- If you’re close to the Lifetime Allowance (LTA) – Pension contributions after breaching the LTA is taxed (at 55% in case of lump sum withdrawn and 25% in case of annuity payments) and the limit is tested in case of transfer to QROPS at the time of transfer and not thereafter. The current life time allowance is £ 1 MN combined for all such schemes taken together. Usually, the pension provider will deduct this tax while making the payment and you can claim the credit of this tax in your self assessment tax return (more information here)

- If you’ve been invested in a defined “benefit” scheme: Generally, the pension accumulation in a defined benefit is not expected to be much, especially because the investments are made in low risk investments to give a guaranteed return. If you’re not ok with this, a movement to an QROPS can give you wider investment choices (along with some risk of course) and you can expect a better return from your pension accumulation over a longer period.

- If you do not wish to have currency risk in your investment portfolio: For a personmoving to India for permanent settlement, the UK pension component of investment portfolio (especially if it is large) poses a currency risk – by the time person retires, if INR appreciates against the £, to that extent the investment returns can get eroded and thus impacting the retirement calculations. Hence, for such returnees, this can be a serious reason to consider moving pension to an Indian QROPS. Read more about currency risk here: How NRI/PIO families can manage exchange rate risk in their investments

- You do not wish to pay UK inheritance tax: UK pension may qualify for inheritance tax if the value of estate (including the pension accumulation) exceeds £ 3,25,000 – in such case, any distribution over and above this limit to a non-spouse/civil partner can attract a 40% tax. For a non-UK resident, an overseas pension (like a QROPS) does not qualify for inheritance tax.

Before transferring your UK pension to overseas jurisdictions, read this

A very important development that has happened is that effective March 09, 2017, any pension transfer to a non UK pension scheme MAY attract a 25% tax charge in some cases. I am giving below the extract from the HMRC website:

“……….

1.10 If you transfer your pension savings to a non-UK pension scheme and that scheme is neither a

- registered pension scheme

- QROPS

you will be liable to a tax charge (the unauthorised payments charge) of a least 40% of the amount of the transfer.

1.11 You are responsible for making sure that the non-UK pension scheme is either a QROPS or a registered pension scheme at the time the transfer is made.

1.12 If you request a transfer from a registered pension scheme to a QROPS on or after 9 March 2017 that transfer may be liable to a 25% tax charge called the overseas transfer charge.

1.13 In this context, a transfer has been requested when you have made a substantive request to the scheme administrator of your registered pension scheme on which they are required to take action in relation to the transfer. This means that you have given the scheme administrator an instruction to transfer £X or X% of your pension funds to a named overseas pension scheme. A casual enquiry is not a transfer request.

1.14 If you want to make a request for a transfer of your pension funds from a registered pension scheme to a QROPS on or after 9 March 2017, you should check whether the transfer will be subject to the overseas transfer charge. The guidance below under Overview of the overseas transfer charge explains when a transfer to a QROPS will be subject to the overseas transfer charge and gives details of the conditions which need to be met if the transfer is not to be subject to the charge.

Which transfers from registered pension schemes are chargeable

2.12 The overseas transfer charge arises on all recognised transfers to QROPS that were requested on or after 9 March 2017 if:

- the member has not provided the scheme administrator with all the required prescribed information before the transfer is made

- none of the following five conditions are met:

- the member is resident in the same country in which the QROPS receiving the transfer is established

- the member is resident in a country within the European Economic Area (EEA) and the QROPS is established in a country within the EEA

- the QROPS is set up by an international organisation for the purpose of providing benefits for or in respect of past service as an employee of the organisation and the member is an employee of that international organisation. PTM112200 provides guidance on the definition of an international organisation. It does NOT simply mean a multi-national employer.

- the QROPS is an overseas public service pension scheme and the member is an employee of an employer that participates in the scheme

- the QROPS is an occupational pension scheme and the member is an employee of a sponsoring employee under the scheme

………”

Source: HMRC website Link

So, there are two main tax implications here:

- If you transfer to an overseas pension scheme that do not meet HMRC tests: 40% tax

- If you are returning and become a resident of India and have shifted your pension to another jurisdiction say Malta: 25% tax

Important points in the above context are as follows:

- Before transferring, you need to be reasonably sure whether you’re returning to India permanently or have plans to move back to UK/other country – if answer is the former, you can consider Indian QROPS and in case of latter, you can either leave the UK pension untouched or move it into a Self-invested personal pension (SIPP) – read more about SIPP here

- The new regulation only affects pension transfer requests made on or after 09/03/2017 – so, any pensions already transferred/in process before this date remains unaffected.

My sense of this new development is that for returnees who wish to settle permanently in India, this move makes transfers to Malta and other jurisdictions highly unattractive and as a result, the biggest beneficiaries of this will be the Indian QROPS.

How to check whether a QROPS complies with HMRC tests?

As I’ve explained above, if the pension is transferred to an overseas pension scheme which is NOT a recognized QROPS as per HMRC, there is a flat 40% UK tax on such transfer. In this regard, HMRC has laid out detailed tests that the overseas pension scheme should qualify in order to be recognized and free from the 40% tax incidence as mentioned.

Important thing to note here is this: the obligation is upon the pension holder (i.e. YOU) to ascertain whether the scheme meets the tests or not. Generally, when you try to transfer your pension, you come across fancy presentations from the pension providers whose ultimate aim is to manage your money and earn from the fee. Here, please understand that whatever the provider of pension promises or tells you has no consequence whatsoever if later HMRC comes to know that it was qualifying the tests on the date of transfer.

Also note that though HMRC has published list of QROPS schemes on its website, this list is a self-declaration by scheme owners that it complies with HMRC requirements. HMRC has made it clear that it has not vetted/approved any scheme and UK tax @ 40% can arise even if scheme is on this list and does not comply to the HMRC tests.

In such situation, given that the responsibility of due diligence is on you, how do you go about taking a decision – a couple of pointers from my side are as follows:

- Read the HMRC tests YOURSELF – ask questions to pension provider and get written responses. Ask for the scheme document and read the fine print. Do not blindly invest by looking up the HMRC list.

- In case a scheme being derecognized or due to any reason that you wish to move out of the scheme and transfer to say another jurisdiction, check what are the applicable charges.

- If all this proves too technical for you, hire a FCA licensed financial adviser to advise you for a FEE – most of the times, you can come across advisers who have some sort of a compensation arrangement with these providers (generally an agreed % for pension transferred) – in such a case, a clear conflict of interest exists and it is better not to seek advice from such an adviser – while selecting a financial adviser, make proper enquiries on their compensation model and also preferably take it in writing that he does not earn any commissions/flowback from pensions providers and other financial product manufacturers.

HMRC rules for QROPS

HMRC has clearly set out the rules for an overseas scheme to qualify as a QROPS for UK tax purposes. I have given below an extract of the wordings (do note that there have been some minor changes to these rules from April 6, 2017)

“….

New regulatory requirements test

Currently if there is a regulator of the type of pension scheme in the country or territory in which the scheme is established, the scheme must be regulated by that regulatory body. If the scheme is not regulated it can’t be an overseas pension scheme.

If there is not a body that regulates pension schemes, a scheme can still be an overseas pension scheme if one of the following applies:

- it is established in a EU member state (other than the UK), Norway, Liechtenstein or Iceland

- the scheme rules require that at least 70% of the member’s UK tax-relieved funds will be used to provide them with an income for life

From 6 April 2017 how a scheme satisfies (passes) the regulatory requirements test will depend on whether or not it is an occupational pension scheme.

Overview of changes to the recognised overseas pension scheme conditions

To be able to be a QROPS, in addition to being an overseas pension scheme the scheme must also meet the conditions to be a recognised overseas pension scheme (ROPS).

Currently, unless the scheme is set up by an international organisation or is a public service pension scheme, to be a ROPS the scheme must meet both of the following:

- the pension age test

- the benefits tax reliefs test

From 6 April 2017 to be a ROPS a pension scheme must be established in one of the following:

- an EU member state (other than the UK), Norway, Liechtenstein or Iceland

- a country or territory with which the UK has a double taxation agreement that makes provision for exchange of information

- a country or territory with which the UK has a tax information exchange agreement (TIEA)

If the scheme is established in Guernsey and approved under section 157E of the Income Tax (Guernsey) Law 1975 it must also be closed to non-residents

Pension age test

Currently the pension age test requires that payments can’t be made to the member if they are under the normal minimum pension age (55) unless they are retiring due to ill-health. There are certain authorised payments a registered pension scheme can make to a member aged under 55, for example a refund of excess contributions lump sum. From 6 April 2017 the pension age test will be amended to allow schemes to make payments to members aged under 55 if the payment would be an authorised payment if it was made from a registered pension scheme.

Authorised payments that can be made to a member aged under 55 are:

- a serious ill-health lump sum – see PTM063400 for payment conditions

- a short service refund lump sum – see PTM045000 for payment conditions

- a refund of excess contribution lump sum – see PTM045000 for payment conditions

- a winding-up lump sum – see PTM063600 for payment conditions

….”

Source: HMRC website Link

Do Indian schemes on the list comply with the HMRC rules?

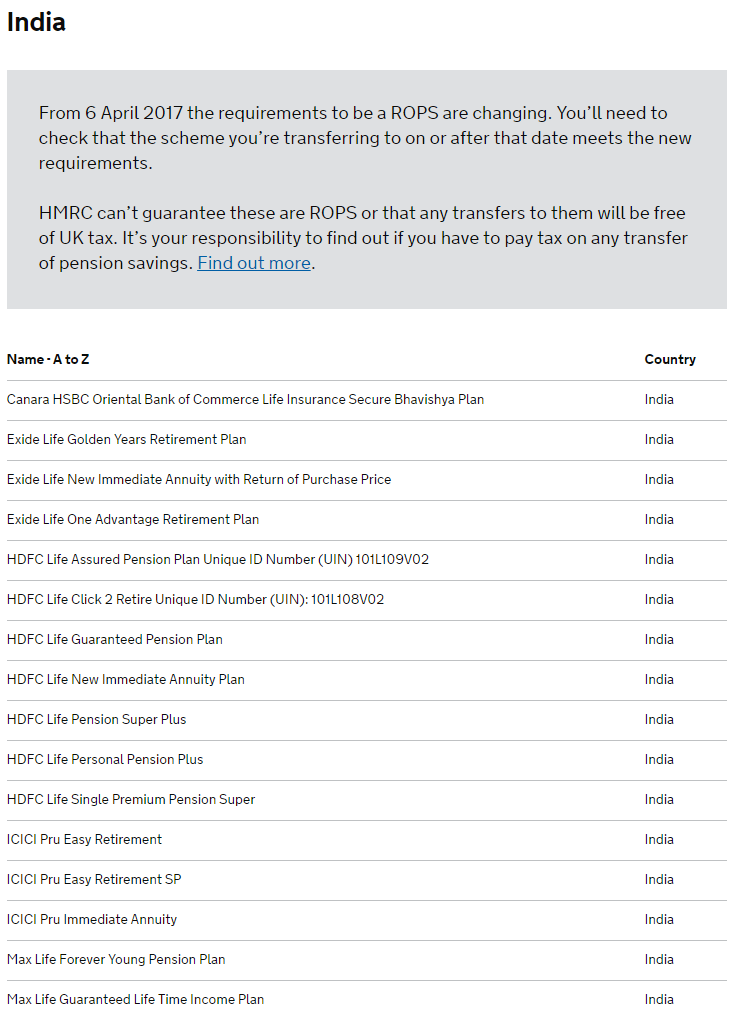

If you see, as on date that I am writing this post, some 16 Indian schemes have told HMRC that they qualify on the HMRC tests. The list is given below:

Please understand – there may be schemes which may qualify and have not told HMRC of this – whether you can invest in those, I am not sure. However, after going through the HMRC rules, following are the applicable rules and my view on whether Indian schemes qualify:

Test # 1: Regulatory Requirements Test

This rule requires scheme to be regulated by a regulator – note that in India, we have Pension Fund Development and Regulatory Authority (PFRDA) as one regulator which has only one product in its basket and that is NPS –to the best of my knowledge, NPS does not accept inward contributions by way of overseas fund transfers – (I wrote to a senior person in their team on a possibility of this but as far as now, have not heard from them)

However, good news is that Insurance and Regulatory Authority of India (IRDAI) regulates pension products issued by life insurance companies (including those mentioned in the list)

My feeling is that this is a sufficient compliance to this test. If one takes an argument that it is the PFRDA which is the regulator for pensions products in India, and products on the list do not come under PFRDA, in my view that will be too technical an argument. In all fairness, the fact that IRDA regulates the pension product in which UK pension will be transferred should be enough, but cannot say anything with finality.

Test # 2: Benefits tax reliefs test

This rule requires India to have a double taxation avoidance agreement which permits exchange of information between countries.

It may be noted that India has a proper DTAA with UK and there is a specific Article (Article 28) on exchange of information so in my view this test is met.

Test # 3: Pension Benefits Test

This rule says that pension payments CANNOT start before 55. The logic behind this seems to be that HMRC wants to extend tax benefit to overseas transfers only to “genuine” schemes which are by nature, pension schemes and not investment products.

Now, if you see, IRDA regulations do not per se prescribe that vesting age cannot be less than 55. It is here that you need to actually see the product policy wordings – if a plan/scheme allows a normal vesting age below 55, in my view, it does not meet the HMRC requirements and hence MUST be avoided.

It is impractical for me to review the individual product docs for each product on the list but I just picked up HDFC Click2Retire and came to know that it’s minimum normal vesting age is 45 years – prima facie, I can say that this product does not meet the HMRC rules and as a result, if you transfer your pension to such product, it can cause a 40% UK tax liability.

It is also important to note that what is relevant for purpose of the test is whether “scheme allows it or not” and not “whether you actually take a distribution before 55 or not” – if the scheme allows you to take a distribution before 55 and you take it after 55, can you say that scheme complies with the pension age test? In my view, NO.

So, I request you to please check and double check with the insurance company and your licensed adviser in UK on these tests before you take a decision and as I said, don’t go blindly by what the HMRC list says or the agent tells you.

Whether I should retain or transfer my UK pension to India

Having seen the applicable laws and regulations, let us now come to the big question. Please understand that this question has no straight yes/no answer and depends on a person’s unique financial situation. However, any option you select will have some e pros and cons, as are given below:

Option # 1: Retain the pension (or move it to an SIPP)

Pros:

- You will have a geographical diversification in your investment portfolio.

- If you have GBP denominated financial goals (e.g. sending kid to college in UK) or plan to retire back in UK, you save yourself from currency risk in the portfolio.

- There is no risk of a 40% UK tax if HMRC later comes to a conclusion that it does not meet its tests

- If you later change your residence country, there is no 25% UK tax implication

Cons:

- The investment will no longer be a tax free investment for you. Dividend/Interest/Capital Gains income will be taxable in India as per your slab rate/special rates as discussed above. Also read: xxxxxxxxxxxxxxxxx

- If you have returned to India for permanent settlement and have no financial goals in non-INR currency, amount represented by way of UK pension in £ will cause an exchange risk in your investment portfolio.

- On death, UK pension will form part of your estate and subject to inheritance tax in UK. However, inheritance tax is applicable in UK only of value of estate is > £ 3,25,000 or if assets are going to a person other than your spouse etc., so see if it really applies to you.

- You need to file complicated foreign income tax returns every year and offer income to tax in India – any miss and severe penal implications (including possible jail term) in India may follow. Also read: Black Money Act: An Analysis CA will charge a higher fee for filing foreign income returns every year in view of the complexity and calculations involved.

Option # 2: Transfer the pension to an Indian QROPS

Pros:

- You will lose geographical diversification in your investment portfolio to that extent – however, you can still invest in UK markets through dedicated feeder funds from India depending on your requirement.

- You settle the tax issues once and for all – no more foreign income returns and associated complexity, no more risk of litigation with tax office etc.

- Transfer within RNOR period will not cause any tax liability in India (note that transfer on or after you get a ROR status is a grey area under Indian tax law – such transfer is not specifically excluded from definition of “transfer” and hence may be taxable – as far as possible, transfer during RNOR period)

Cons:

- You will have to live with a residual risk that at a later date, HMRC comes to a conclusion that the Indian scheme does not meet its tests and hence the 40% tax

- India does not have a very well developed annuities market and the rates are quite low (I cannot say how Indian annuities compare to annuities in UK though)

- If you later change your residence country, there may be a 25% UK tax implication

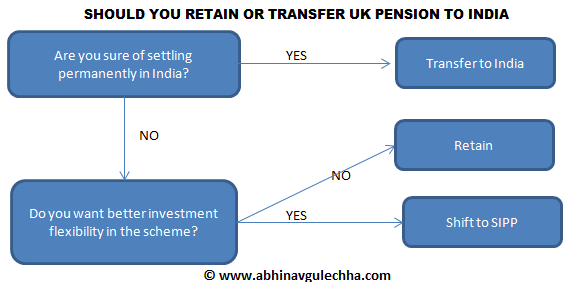

I am summing up this issue of retain/transfer in a simple two point flowchart below:

Hope the post has been of service to you.

For personalised consultation, you can reach out to me at contact@abhinavgulechha.com